Pappas: Property tax bills will soon be due. Are you getting all your exemptions?

Your Property Taxes with Cook County Treasurer Maria Pappas

By Maria Pappas

If you own a home or other real estate in Cook County, chances are you will have a property tax bill due soon.

Property taxes in Illinois are billed in two installments yearly. For the 2022 tax year, First Installment bills were mailed at the beginning of March and were due April 3.

Second Installment bills are expected to be available Oct. 17 to be viewed, downloaded and paid at cookcountytreasurer.com. The bills will be mailed on or about Nov. 1 and are due Dec. 1.

To pay online, visit the website and click on the blue “Pay Online for Free” box on the home page. Enter your address or Property Index Number (PIN) and follow the steps to pay electronically.

You can also pay your property taxes at any Chase Bank location, at more than 100 community bank branches where you have an account or at the Treasurer’s Office on the first floor of the County Building, 118 N. Clark St., Chicago.

Paying taxes on time saves money by avoiding interest charges on late, or delinquent, tax bills. For many years my office has accepted partial payments. Many homeowners struggle to come up with two lump sum payments every year. People with home loans typically avoid this by paying monthly installments toward their tax bills as part of their mortgage payments, called paying by escrow.

Those without mortgage escrows can make partial payments toward their tax bills at any time. Taxpayers who make partial payments can search their address or PIN at cookcountytreasurer.com and learn the remaining balance they owe.

The property tax system is complex and can be confusing. Most property owners are entitled to tax breaks called exemptions. I talk to people all the time who tell me they didn’t know about exemptions or that they had to apply for them.

The Homeowner Exemption is the most common. People who live in a home that is their primary residence qualify for this tax break. Once they apply and receive the Homeowner Exemption, it automatically renews each year.

Another common tax break is the Senior Citizen Homestead Exemption. People qualify the year after they turn 65, since payments you make at a due date cover taxes billed for the previous calendar year.

Older taxpayers may also be entitled to the Low-Income Senior Citizens Assessment Freeze Exemption. Senior citizens whose total household income is $65,000 a year or less qualify for this exemption, which requires an application every year.

Other types of exemptions benefit veterans and people with disabilities. To learn more about exemptions, visit cookcountytreasurer.com.

- Robert F. Kennedy should be allowed to participate in presidential debates - April 29, 2024

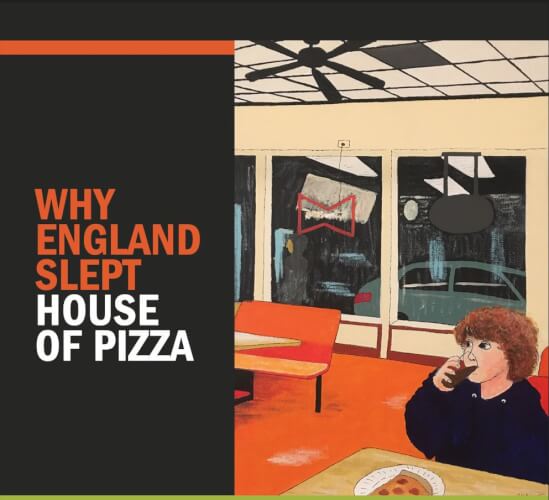

- WHY ENGLAND SLEPT releases “House of Pizza” - April 26, 2024

- Leving team frees duped dad from paying child support for another man’s child - April 26, 2024