Treasurer Maria Pappas postpones collections to help coronavirus victims

Video Interview Below: Cook County Treasurer Maria Pappas has launched an initiative to help taxpayer san property owners who have been economically impacted negatively by the Coronavirus COVID-19 pandemic. The Treasurer’s office will extend the period by two months in which property owners can pay their taxes, delay the sale of delinquent properties in which taxes have not been paid for 13 months, and is offering several programs to help offset their tax bill debts

By Ray Hanania

Cook County Treasurer Maria Pappas on Monday announced that she will implement several new programs to help property owners who have been slammed by the coronavirus and are unable to pay their taxes.

Pappas, who has been on the cutting edge of helping tax payers for years since she was first elected Treasurer in 1998 after serving four years on the Cook County Board, said her initiatives will help everyone whose economic standing has been negatively impacted by the COVID-19 pandemic.

According to Pappas, the initiatives include:

1 – Automatically apply a two-month delay in paying property taxes, usually due on August 3, 2020;

2 – Allow homeowners to check to see whether they have received discounts for any county exemption they may qualify for but did not take such as for homeowners and seniors, and apply those exemptions if they were not taken to their tax bills. Pappas said there is more than $44 million in outstanding refundable monies;

3 – Allow homeowners to check the Treasurer’s computer data to determine if their property tax payments have been paid in duplicate (something that happens as a result of monies collected and paid during purchases, changing banks or other reasons, more than $79 million Pappas said..

4 – Finally, properties with unpaid taxes of more than 13 months normally go up for sale but Pappas said she is pushing to delay that sale another 13 months through the support of the Illinois legislature.

“Waiving interest on late property tax payments for two months will give taxpayers financial relief and more time to manage their finances,” Pappas explained during an interview Monday.

Pappas said the delay has bene introduced to the Cook County Board meeting on Thursday and is expected to be immediately approved.

“We want to get relief on penalties by delaying tax payments by two months. We are asking everyone to go to CookCountyTreasurer.com to put in their address to see if they have a double payment, one of the $79 million. We are asking them to check to see if they got the correct exemptions, another $44 million that is there.”

Pappas said that Cook County needs to get its act together here.

“The ordinance that is before the Cook County Board this Thursday will allow a complete waiver. If you don’t have money on August 3, you will pay on October 1st with no penalty,” Pappas said.

“You are now given two months to juggle, to figure out if you can get a job, or figure out where this money might come from.”

Pappas said that if someone can’t pay on October 1st, her office will reduce the interest penalty from 4.5 percent for late payments to 1.5 percent.

But Pappas added that she is adding several other options that could help, including checking the County Treasurer’s website to see if they have duplicate tax payments from past years.

More than one million people have accessed the Treasurer’s website at www.CookCountyTreasurer.com which is available in 126 different languages. Pappas said there have been more than a half million downloads in languages other than English including 162,000 just in the Polish language and 17,000 downloads in Arabic, she noted.

“You go to the Treasurer’s website and enter your property address, home or shopping center, or whatever you own. You will then be able to scroll down and see if there is a duplicate payment there,” said Pappas who noted there is more than $79 million in duplicate payments that have not been collected by taxpayers.

“They can find out if a duplicate payment has been made and they can apply those funds to their tax bills this year.”

Pappas said that’s not all that her office is providing to taxpayers.

“If you scroll down on that page, you will see four boxes, for exemptions for the Homeowner’s Exemption, Senior Exemption, the Senior Freeze and you can check to see if you were given credit for those exemptions if you qualify,” Pappas explained.

“A lot of people who owe a lot of money in taxes, have not claimed these exemptions. I’m going to give you an example.

“I’m a senior. I received a notice from the Assessor in 2016 that I was supposed to apply for my senior exemption. I didn’t get the Homeowners Exemption or the Senior Exemption. That’s $1,000, or $500 each just for 2016. I didn’t do it in 2017, 2018 and 2019. I am owed $4,000 and my property tax bill is only $2,000.”

Pappas said taxpayers can submit a form through her office and website at www.CookCountyTreasurer.com, and the public will get the application which taxpayers send back to my office and we will process in four to 10 weeks.

“If they qualified for the exemptions but did not claim them in the past, they will get credit for what was supposed to be deducted and applied to their bill,” Pappas said.

“Their bill will reflect the money that is owed to them and reduce what they must pay.”

Pappas said that the funds exist and have not been claimed and will be applied to what they owe, helping many who are facing economic hardships because of the coronavirus or other reasons.

Pappas said that many of the people who are owed money are ethnics and immigrants who are not used to receiving property tax exemptions.

“How do you translate ‘senior exemption’ or “homeowners’ exemption” in their language. The only way is to explain to them that they can save $500 for each of those years and it will be applied to their upcoming tax bills,” Pappas said.

“We want to get relief on penalties by delaying tax payments by two months. We are asking everyone to go to CookCountyTreasurer.com to put in their address to see if they have a double payment, one of the $79 million. We are asking them to check to see if they got the correct exemptions, another $44 million that is there,” Pappas said.

“May 8 was supposed to be the sale of 43,000 properties that owe taxes. That has been cancelled. We went into court and got a judge to stay the sales,” Pappas said.

“These are properties that have gone unpaid for 13 months and are automatically put up for sale.”

The State Legislature is considering to extend the payment period which was reduced years ago to nine months and restore the time to repay to 13 months.

You can view a video interview with Pappas on SuburbanChicagoland.com.

Pappas said homeowners can either go online to CookCountyTreasurer.com or, if property owners don’t have internet access, they can call her office directly at 312-443-5100.

Click this link to watch the video interview or use the Vimeo widget below:

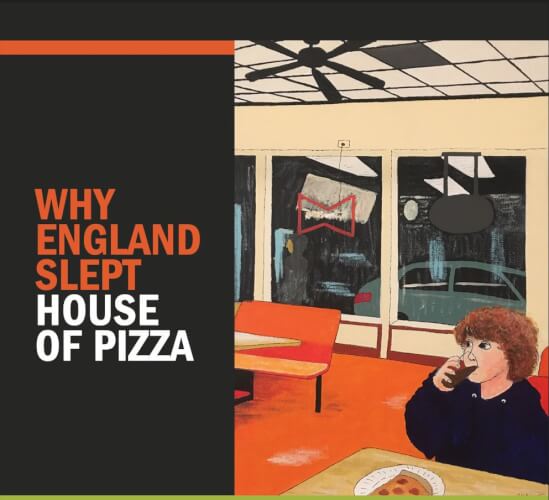

- WHY ENGLAND SLEPT releases “House of Pizza” - April 26, 2024

- Leving team frees duped dad from paying child support for another man’s child - April 26, 2024

- Fire damages Al Bahaar Restaurant in Orland Park - April 23, 2024