Click here to subscribe FREE to Ray Hanania's Columns

Seniors deserve far more benefits than they get from our government

Not enough is being done to help Senior Citizens who are earning under $100,000 in total household income including Social Security retirement income. Politicians, government, activists like the worthless AARP, and the news media all pander to Seniors to exploit them for their own financial benefit, but none are really doing anything to help them. This plan, the Senior Tax Waiver idea would change that and give Seniors the benefits they earned

By Ray Hanania

There needs to be a revolution to help senior citizens in America. Although everyone from government to the news media talk about how important senior citizens are, very few offer any real solutions to the challenges they face.

The elected officials, government agencies, news media and even the AARP all exploit the country’s baby boomers for personal gain.

Politicians love to pander to Seniors because as a group, Seniors vote at the highest percentage of any other demographic. Elected officials need Senior votes and they will say anything to get Senior voter support. But, the politicians and government don’t deliver.

The so-called lobby for Seniors, the AARP, or American Association for Retired Persons, profits more from their efforts than Seniors benefit from AARP membership. AARP is basically a for-profit lobby that collects Senior information and sells it to advertisers for great profit. As a former AARP member, the most I received was to be inundated with junk mail pitches from companies trying to sell me Medicare scams, subscriptions, costly “help” services, and worthless garbage.

But despite all the empty words, exploitation, pandering and limited assistance we get, the truth is Seniors are at the end of the line when it comes to the government’s and the public’s attention.

Here is what government is doing for us.

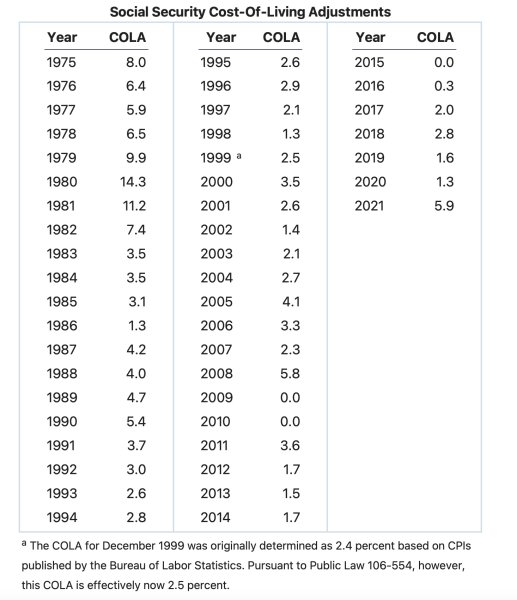

President Biden and Congress are bragging that they are raising the COLA (Cost of Living Adjustment) on Social Security by 5.9 percent. That’s great, but look back at the history how it hasn’t been raised and you realize they have been cheating us for decades.

Worse, is that while they are increasing the COLA by 5.9 percent, they are ALSO increasing the monthly premiums paid for Medicare Part B by 15 percent.

In the end, one hand washes the other and you get no real benefits and Seniors earning $100,000 or less will be struggling to pay their bills. Most Seniors earn far less than $100,000 — in all honesty, $100,000 in annual income is the “New” $45,000 in annual income. In other words, $100,000 today is worth far less than it did 40 years ago and it will continue to lose value especially for Seniors as they age.

So, I have come up with a plan to help seniors that won’t cost as much as many people think. It’s called the Senior Tax Waiver for Seniors collecting Social Security whose total income is under $100,000 for one Senior in a household; or, under $150,000 for two Seniors in a household.

It’s simple. Waive ALL TAXES for Seniors in those two income groups.

The goal is to protect Social Security income and allow the Senior to still do some work to a total combined taxable income of $100,000. They would benefit from the plan’s other tax, healthcare and prescription waiver benefits.

There are Four Categories of qualification based on whether you are one or two Seniors collecting Social Security, and earning either $100,000 or less, or $150,000 or less in total income. ALL Taxation of all kinds would be waived.

There is a limiting category for Seniors who earn $250,000 or less which only waives Federal and State income taxes on the first $100,000 or $150,000 (depending on whether there is one or two Seniors (married) in a household.

Anyone earning more than $250,000 would not qualify for the Senior Tax Waiver.

Here are the Categories of Waiver Benefits:

Category 1:

Who qualifies: Seniors 65 and older collecting Social Security and earning under $100,000 in total combined household income, (including married couples with one spouse under 65 who is not collecting social security).

Benefit: Eliminate all taxation up to $100,000. No income taxes (Federal or state). No property taxes (or possibly a property tax reduction of 50 percent to a ceiling of $3,500 a year).

Benefit: Receive FREE healthcare and Prescription Drugs for seniors, and reduced costs for spouse under 65 with no “donut hole” and no out-of-pocket costs or annual deductible.

Benefit: Encourage through legislation utility companies to reduce charges by 50 percent for (electricity, water, telephone, gas, cable TV, WiFi.

Category 2:

Who qualifies: Married couple Seniors both over 65 and both collecting social security, earning a combined taxable income under $150,000.

Same as Category 1 except that with two qualifying married Seniors collecting Social Security, the income limit rises to $150,000 instead of $100,000.

Benefit: Eliminate ALL taxation for the first $150,000. No income taxes (Federal and state), and no property taxes (or a property tax reduction of 50 percent to a ceiling of $3,500 a year).

Benefit: receive FREE healthcare and prescription drugs for both seniors.

Benefit: Encourage through legislation, utility companies to reduce charges by 50 percent.

Category 3:

Who qualifies: Seniors 65 and older collecting Social Security and earning a combined Household taxable income of under $250,000 (including married couples with one spouse under 65).

Eliminate Federal and State income taxes on income up to $100,000 but resume the tax on income above $100,000.

Category 4:

Who qualifies: Married couples in which both are over 65, and both are collecting social security, earning a combined taxable household income of under $250,000.

Eliminate Federal and State income taxes on income up to $150,000 but resume the tax on income above $150,000.

Category 5:

Any Senior or married Seniors collecting Social Security and earning a combined taxable Household income of more than $250,000 would not qualify for the waiver.

Critics will say it is expensive. It’s not when you compare it to the unfunded mandates and social programs now being funded. The billions being waived in outstanding education loans (those that continue to be paid through government agencies and those that were consolidated and converted to private banking outlets), or the benefits that fuel the profits of the Insurance industry, the pharmaceutical industry, and big corporations.

After all that Seniors have done for this country, the country should do something for them.

Send this to your local member of Congress and Senate and see what their reaction is.

Will they Sponsor it?

Examples:

A Senior 65 earning $30,000 a year in Social Security, who is married to a spouse not collecting social security, and they are both working but earning a total household taxable income that is under $100,000. They would be in Category 1 and receive all of the benefits. [Total household income, under $100,000, one senior on social security.]

If the spouse is also collecting social security, say $25,000 a year, and the two are still working earning under $150,000, they would be in Category 2 and receive all of the benefits. [Total household income, under $150,000, two seniors on social security.]

If a senior 65 and older is receiving social security, let’s say $30,000, but is still working and earning a total household taxable income of more than $100,000 — let’s say a total of $190,000 a year — then the senior’s first $100,000 would be non-taxable and all income over $100,000, or $90,000, would be taxable. That would be Category 3. No other benefits would apply, however. [Total household income, under $250,000, one senior on social security.]

If two married seniors both collecting social security and are still working, and their total income is let’s say $230,000, their first $150,000 would be tax-free and they would only pay taxes on the excess income above that which would be $80,000. They would be in Category 4. No other benefits would apply, however. [Total household income, under $250,000, two seniors on social security.]

( Ray Hanania is an award winning former Chicago City Hall reporter. A political analyst and CEO of Urban Strategies Group, Hanania’s opinion columns on mainstream issues are published in the Southwest News Newspaper Group in the Des Plaines Valley News, Southwest News-Herald, The Regional News, The Reporter Newspapers. His Middle East columns are published in the Arab News. For more information on Ray Hanania visit www.Hanania.com or email him at [email protected].)

SUBSCRIBE BELOW

Click here to subscribe FREE to Ray Hanania's Columns

- Moderate Jewish Lobby J Street denounces Trump war on Iran - February 28, 2026

- Sean Casten Statement on US Military Action in Iran - February 28, 2026

- Phil Andrew: Attack on Iran Without Congressional Approval Risks American Lives - February 28, 2026