Kaegi Vows to Fix Broken Property Tax System

Cook County assessor hopeful Fritz Kaegi, who bested incumbent Joseph Berrios in the Democratic primary, pledged to attendees of an Illinois Campaign for Political Reform event that the obscure yet critical office will be more transparent and accountable under his watch.

“You don’t need me to tell you what happens when government offices get corrupted for the political and economic benefit of the select few,” Kaegi said at the Aug. 22 “Show Us the Money” forum. “Ethical issues, a lack of transparency, pay to play, nepotism – these are all hallmarks of machine politics.”

Kaegi, an asset manager from Oak Park, beat two-term incumbent Berrios, then head of the Cook County Democratic Party, with 45% of the vote in a three-way March primary. Kaegi repeatedly criticized Berrios for overseeing an unfair property tax assessment system while he hired relatives and took campaign cash from lawyers doing business with the office. Kaegi spent more than $2 million in the race, most of it his own money.

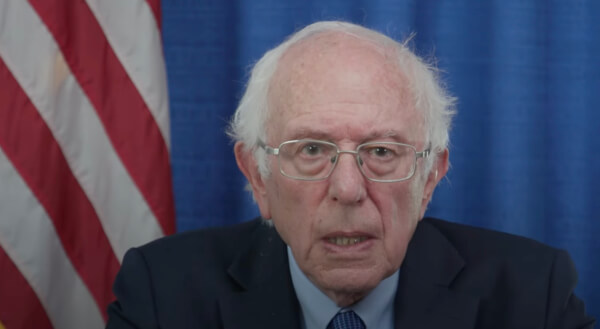

View the video of Kaegi’s comments using the widget below or by clicking here.

Kaegi gave a 25 minute opening speech at ICPR’s “Show Us the Money” forum at the Union League Club of Chicago on Aug. 22.

The assessor’s office evaluates all properties in the county to determine their taxable value. If properties are assessed at more than they would sell for, then those owners pay more in property taxes than they should and vice versa.

A Chicago Tribune and ProPublica Illinois investigative series titled “The Tax Divide” found last year that systemic problems with the county’s assessment process were leading to poor residents paying more than their fair share in property taxes. The reporters who wrote the series headlined ICPR’s first “Show Us the Money” forum in July.

Kaegi gave a 25 minute opening speech followed by a question and answer session with ICPR Executive Director Mary Miro and forum attendees. Kaegi told attendees the inequities in the assessment system create real economic consequences for the average person.

“This is money that should be kept in people’s pockets to spend on their families. It’s money that’s not supporting local businesses. It’s money that’s not generating jobs in the neighborhood,” Kaegi said. “This is displacing people from their homes and creating vacancies. In total, what this does is lead to shrinking populations and boarded-up storefronts and neighborhoods.”

Since winning the primary, Kaegi said he and his team have focused on creating a plan to make the assessor’s office “ethical, transparent and fair.” Kaegi has promised not to accept campaign contributions from property tax lawyers doing business with the office. He has also promised to have third parties evaluate the assessment system to ensure fairness.

Miro asked Kaegi how he will prioritize his agenda and when residents can expect reforms to take shape. Kaegi said instituting high ethical standards will create the most immediate impact.

“That’s the necessary starting point for making the change, changing the culture, for building trust,” Kaegi said. “It will also be very healthy for people working in the office to know that we can’t be getting it wrong and not be held accountable for it.”

The next step, he said, is to ensure the assessment system is repaired and made transparent to the public as soon as technologically feasible. Kaegi said modeling an assessment system will be a “slow grind” because of how large Cook County is. Therefore, he said his team will be focused on properly training and equipping staff with better technology to ensure the assessments are done accurately the first time.

Kaegi vowed to have a sense of urgency about his reform plans.

“It’s urgent because every year that this happens people are being displaced,” Kaegi said. “This is money out of people’s pockets [and] people are being driven into bankruptcy.”

Kaegi faces Republican candidate Joseph Paglia of Chicago on the November ballot.

Visit Kaegi’s Facebook Page by clicking here.