MyLife.com pays $21 million for misleading public

Government Obtains Settlement for Injunctive Relief and Millions in Consumer Redress from MyLife.com and CEO Jeffrey Tinsley. Social media site slammed for lying to customers and forcing them to pay outrageous subscription costs to search user database, and providing misleading information

Online background report company MyLife.com Inc. (MyLife) and its founder and chief executive officer, Jeffrey Tinsley, have agreed to pay $21 million in consumer redress and to injunctive relief that would require them to comply with the Federal Trade Commission Act (FTC Act), the Telemarketing Sales Rule (TSR), the Restore Online Shoppers Confidence Act (ROSCA) and the Fair Credit Reporting Act (FCRA) in all current and future business activities.

The agreement follows an order issued by a federal district court in the Central District of California on Oct. 19, awarding partial summary judgment to the government.

That order found that MyLife violated the FTC Act, the TSR and ROSCA; that MyLife was liable for $33.9 million in consumer redress; and that injunctive relief would be appropriate to prevent further violations of these laws.

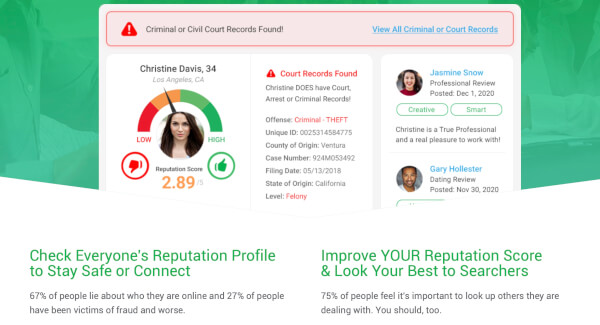

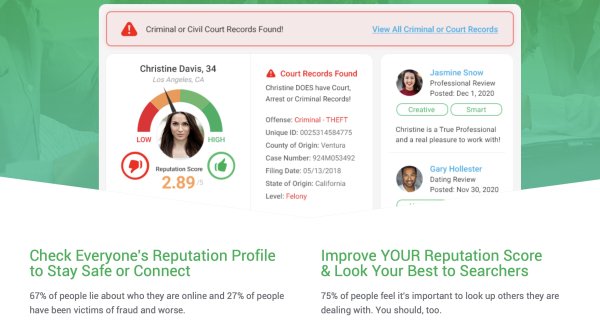

In the complaint filed on July 27, 2020, the government alleged that the defendants sold subscriptions to their website’s consumer background report service by implying, often falsely, that individuals had criminal records that could be viewed only by buying a subscription.

According to the complaint, the defendants also misrepresented or failed to disclose material terms of those subscriptions, including that payment for multiple months was charged upfront, that subscriptions would automatically renew, and that the subscription or automatic renewal could be cancelled only by calling a customer service center that prevented or discouraged cancellations.

The complaint also alleged that defendants were violating FCRA because they promoted use of their background reports, and knew consumers used the reports, for employment decisions, tenant screening or other prohibited purposes, but they lacked reasonable procedures to ensure maximum possible accuracy of their background reports or to determine who was using them and why. For all claims, the government sought civil penalties, consumer redress and injunctive relief from both MyLife and Tinsley.

======================

MyLife.com pays $21 million because it “misrepresented or failed to disclose material terms of those subscriptions, including that payment for multiple months was charged upfront, that subscriptions would automatically renew, and that the subscription or automatic renewal could be cancelled only by calling a customer service center that prevented or discouraged cancellations.

======================

“The Department of Justice and the FTC work hard to protect consumers from deceptive sales practices like those at issue here,” said Acting Assistant Attorney General Brian M. Boynton of the Justice Department’s Civil Division.

“This is a win for consumers, who should not be subjected to misleading statements and marketing tactics.”

“MyLife lured consumers into hard-to-cancel negative-option subscriptions by preying on fears that MyLife’s reports would harm their reputations or ability to find jobs or housing,” said Director Samuel Levine of the FTC’s Bureau of Consumer Protection.

“These extortionary tactics broke the law, and MyLife and its CEO have been banned from negative option marketing and ordered to clean up their practices.”

After filing the complaint, the government substantially prevailed on a motion for summary judgment. In particular, the court found that MyLife engaged in deceptive acts in violation of the FTC Act by misleading consumers with representations that millions of individuals have arrest or criminal records, even though MyLife lacked information to substantiate those claims.

The court also found that MyLife violated the TSR by engaging in sales calls with consumers that failed to disclose material terms and conditions of a MyLife subscription, such as its automatic renewal feature.

The court further found that MyLife violated ROSCA by failing to provide a simple cancellation mechanism for consumers whose subscriptions automatically renewed.

The court also granted the government’s request for consumer redress, concluding that a total redress award of $33.9 million was appropriate for MyLife’s TSR and ROSCA violations.

Following the court’s summary judgment ruling, MyLife and Tinsley agreed to the stipulated order entered today by the court, which imposes significant prohibitions on them and any other present or future companies they own or control.

The provisions bar MyLife and Tinsley from misrepresenting consumers’ legal backgrounds and expressly prohibit them from stating directly or by implication that a traffic citation is a criminal or arrest record. The order also bans MyLife and Tinsley from using a negative-option automatic renewal feature in their current and future business activities. The order includes 20-year compliance and reporting requirements.

The order also includes a $33.9 million total judgment against MyLife and Tinsley, representing the entire amount of consumer redress sought by the government and found appropriate by the court on summary judgment. Tinsley will personally pay $5 million of this sum, with MyLife liable for the remainder. The amount MyLife will pay will be suspended to $16 million, with the suspension to be lifted, if the court finds that either defendant materially misrepresented their financial status or if MyLife fails to make its required payments.

The case was handled by attorneys in the Civil Division’s Consumer Protection Branch, including Senior Litigation Counsel Patrick Runkle and Claude Scott, Trial Attorneys Zachary Dietert, Rachel Baron and Zachary Cowan, and Assistant Director Lisa Hsiao, in conjunction with Andrea Arias, Jamie Elliott Hine, Whitney Moore and Robert Schoshinski at the FTC Division of Privacy and Identity Protection.