Fighting oppressive taxes in Cook County

SW News Group Column March 9, 2017. Cook County Board President Toni Preckwinkle bashed former President Todd Stroger when she ran against him for proposing outrageous hikes in taxes including the sales tax. But as soon as she got to office, she raised the taxes, too. Even worse. The soda tax is the straw that broke the camel’s back for taxpayers in Cook County.

By Ray Hanania

Taxes in Cook County are forcing me to take a closer look at how I spend my hard earned money. One thing I am doing is being more aware of opportunities to save money when shopping.

Cook County taxpayers have to start thinking the way shoppers do who clip coupons. It’s a hassle but it’s a part of their everyday lives. It’s the only way to beat unfair taxes.

For example, every Sunday morning I drive my son to Synagogue in Indiana. Before, I would drop him off, and drive back later to pick him up. Now, while he’s there, I take advantage of the fact that I am in Indiana and I go grocery shopping down the street at the Jewel Osco.

Taxes in Indiana are only 7 percent, compared to 9.75 percent in Orland Park. I save about $20 to $40 every time I shop in Indiana.

(Illinois has a 1 cent tax on food items, Indiana has none. But don’t get dragged into the complexities of the levels of taxation. The bottom line is Cook County is more than other counties. Illinois is more than other states!)

Obviously, if I drove there just to shop, I’d have to figure in the cost of gasoline. But, whether I am in Indiana, or in Will (6.25 percent), or DuPage (7 percent), the gas costs are irrelevant.

Last year, Cook County Board President Toni Preckwinkle rammed through a 1 cent per ounce hike on soda pop. It takes effect July 1. That’s on top of the sales tax rate.

I love Diet Coke and I drink a lot of it, everyday. In all honesty, though, it’s not the increase that upsets me. I’m going to go broke paying 16 cents more for each pop I drink. It’s the principle that upsets me and it should upset you.

Preckwinkle really hasn’t eliminated any waste in Cook County government since she was elected. She could combine agencies to eliminate redundancies and actually lay people off. She could crack down on excessive pensions, the biggest burden on taxpayers.

This is the trend in Cook County politics. Raise taxes instead of providing real leadership.

The soda tax was a major mistake on Preckwinkle’s part. Maybe she doesn’t go grocery shopping the way I do. But my desire for soda pop is want gets me to stop at a grocery store to buy groceries. It’s the lead item that fuels my grocery spending.

I bet most shoppers who drink soda pop are like me. Preckwinkle’s pop hike is the last straw.

Taxpayers need to change their buying habits. It’s easy. Look at your driving and travel habits. Buy food when you are in another county or another state and it’s convenient.

Even if you have to drive to another county, what you spend on gas is better than giving the money to Preckwinkle to waste.

Each time I buy groceries outside of Cook County, I feel good. The savings is measurable. The choice is simple. Either spend 16 cents more on pop and get angry, or spend 16 cents more on gas and feel better.

Illinois clearly has financial problems but when you look at the causes, they all trace back to Cook County and Chicago, bottomless pits of political and wasteful spending that we really don’t have to tolerate.

It’s not just Preckwinkle’s soda tax that bothers me.

I live in Orland Park, which has one of the highest sales taxes in the state, 9.75 percent. When Mayor Dan McLaughlin imposed the 1-cent Sales Tax many years ago, he promised to off-set it for residents by totally rebating their local property taxes we paid.

Of course, as time went on, McLaughlin reneged on the deal. Instead of fully rebating our local property taxes, McLaughlin reduced the rebate. And every four years at election time, we’re reminded that we get our property taxes “rebated.” Well, not “fully rebated.” But it still looks good in the election literature, I guess.

It’s little things like that detail that upset me. I like Dan. He’s a nice guy. Orland has grown enormously over the years. But I hate to see promises change, or promises made that should never have been made in the first place.

Preckwinkle campaigned against her predecessor, Todd Stroger, vowing not to raise the sales tax. Stroger lost because he proposed raising the County Sales Tax 1-Cent. Preckwinkle opposed it. Not long after Preckwinkle was elected, she turned around and hiked the sales tax anyway.

Stroger’s real problem wasn’t his sales tax hike plan. It was his failure to manage county government efficiently. Yet despite that, at least he was honest and a decent person.

(Ray Hanania is an award wining columnist and author who covered Chicago City Hall from 1976 until 1992. Email him at rghanania@gmail.com.)

- Robert F. Kennedy should be allowed to participate in presidential debates - April 29, 2024

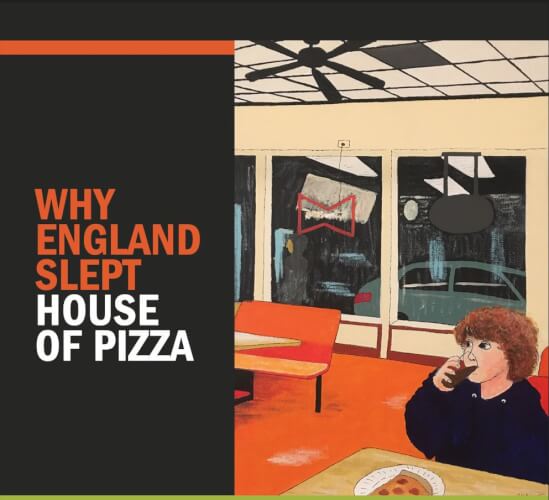

- WHY ENGLAND SLEPT releases “House of Pizza” - April 26, 2024

- Leving team frees duped dad from paying child support for another man’s child - April 26, 2024