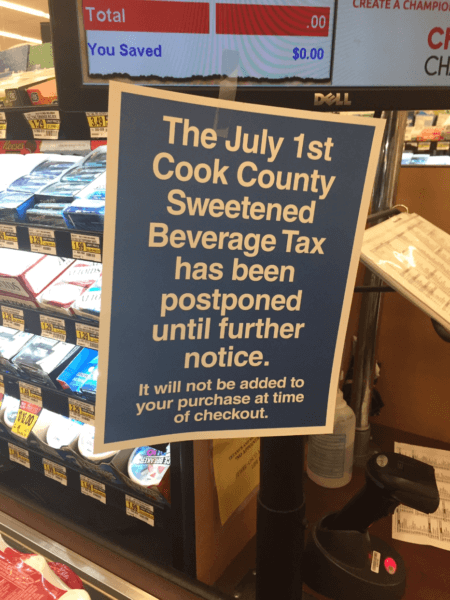

County law would make it harder to pass tax increases

Cook County Commissioners submit bi-partisan amendment to require a two-thirds supermajority vote for any new tax or tax increase

Commissioner Timothy O. Schneider and Cook County Commissioners Richard Boykin, Gregg Goslin, John Fritchey, and Sean M. Morrison will submit a bi-partisan amendment to require that any new tax or tax increase must be passed by a supermajority vote of two thirds rather than a simple majority.

“The intention of this amendment to the county code is to ensure that the will of our constituents is being properly represented,” said Commissioner Schneider. “Imposing additional taxes on the residents of Cook County should require a vote greater than a simple majority”

“Cook County must chart a fiscal course that is based on responsible budgeting and sensible revenue policies. This amendment will assure that any new tax proposal shall meet the highest threshold of consensus by the board. Taxpayers deserve nothing less,” added Commissioner Sean Morrison.

“By implementing this change, the Board will be able to give a greater swath of Cook County residents a say in whether new revenue should be approved,” Commissioner Boykin said. “For too long, the County Board has simply turned to revenue rather than look to creative budgeting solutions.”