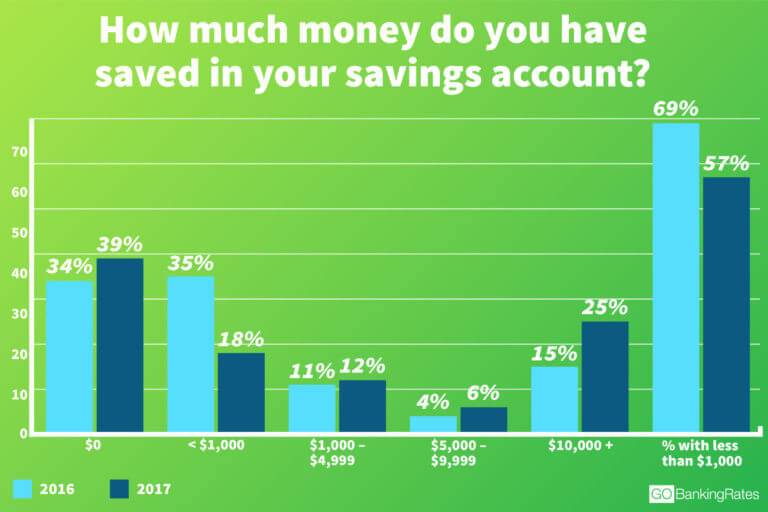

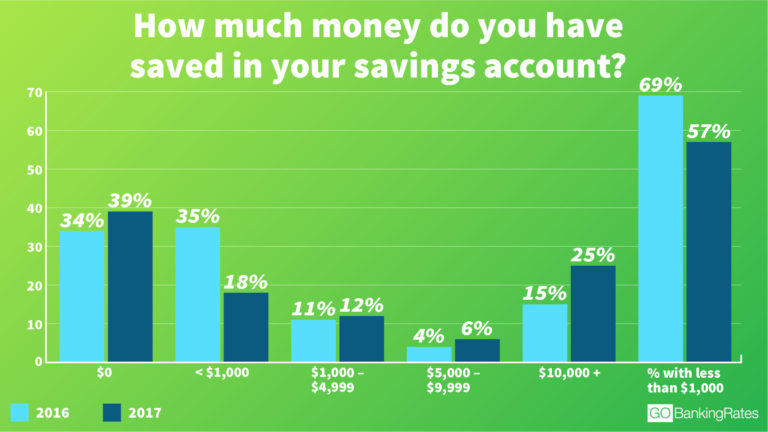

57% of Americans Have Less Than $1,000 in Savings

Millennials are more likely than other generations to have nothing saved, while adults 65 and older are more likely to have $10,000 or more in a savings account. In Illinois, 39 percent of residents have no savings, the GoBanking Survey shows

More than half of Americans have less than $1,000 in savings, a new survey found. In fact, 39 percent of survey respondents said they had no money set aside in savings at all.

For the second consecutive year, personal finance website GOBankingRates asked more than 8,000 Americans how much money they have in their savings accounts. The results revealed that 57 percent of Americans have less than $1,000 in savings — a significant improvement from a similar survey in 2016, which found that 69 percent of respondents had less than $1,000 set aside.

However, the percentage of people with $0 in savings has climbed to 39 percent from 34 percent in 2016. The data is broken down state by state to determine which states had the highest percentage of Americans with little to no savings.

Illinois

- Percentage of residents with $0 saved: 39%

- Percentage of residents with less than $1,000 saved: 56%

Illinois residents appear to be setting aside more money in savings this year. The percentage of residents with less than $1,000 saved has shrunk from 71 percent in 2016 to 56 percent.

Respondents could choose one of the following answers:

- $0

- Less than $1,000

- $1,000-$4,999

- $5,000-$9,999

- $10,000 or more

For full study results and more details on methodology, visit: More Than Half of Americans Have Less Than $1,000 in Savings in 2017.

States With the Highest Percentage of Residents With $0 in Savings

1. Washington, D.C.

- 48 percent of residents have $0 in savings

2. Massachusetts

- 48 percent of residents have $0 in savings

3. Hawaii

- 47 percent of residents have $0 in savings

4. Wyoming

- 47 percent of residents have $0 in savings

5. New Mexico

- 47 percent of residents have $0 in savings

States With the Highest Percentage of Residents With $10,000 or More in Savings

1. Kansas

- 38 percent of residents have $10,000 or more in savings

2. Washington

- 35 percent of residents have $10,000 or more in savings

3. New Jersey

- 34 percent of residents have $10,000 or more in savings

4. North Dakota

- 34 percent of residents have $10,000 or more in savings

5. Kentucky

- 32 percent of residents have $10,000 or more in savings

Additional Study Insights

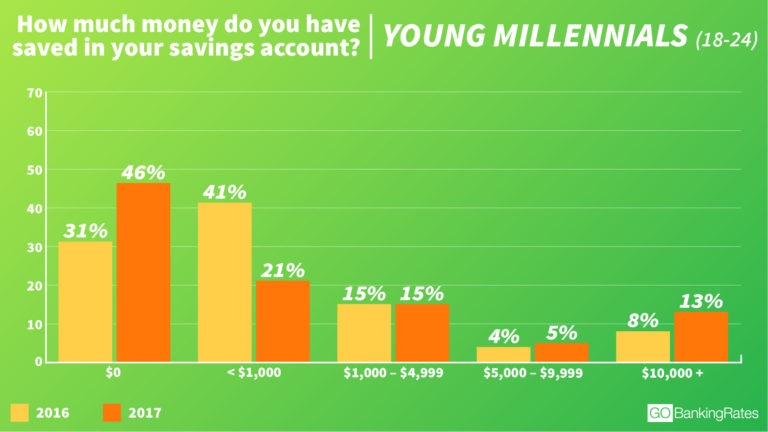

- Sixty-seven percent of young millennials have less than $1,000 in savings — down from 72 percent in 2016. Sixty-one percent of older millennials now have less than $1,000 in savings, compared with 67 percent in 2016.

- The percentage of young Gen Xers with less than $1,000 saved fell 18 percentage points this year.

- Thirty-three percent of baby boomers say they have $0 saved.

- Men have more savings than women, overall. Sixty-two percent of women say they have less than $1,000 in savings versus 52 percent of men.

About GOBankingRates

GOBankingRates.com is a personal finance news and features website dedicated to helping visitors live a richer life. From tips on saving money, to investing for retirement or finding a good interest rate, GOBankingRates helps turn financial goals into milestones and money dreams into realities. Its content is regularly featured on top-tier media outlets, including MSN, MONEY, AOL Finance, CBS MoneyWatch, Business Insider and dozens of others. GOBankingRates specializes in connecting consumers with the financial institutions and products that best match their needs. Start your journey toward a rich mind and full wallet with us here.

For the past two years, GOBankingRates has surveyed Americans to find out how much they have in savings. The results have been disheartening. Last year’s survey found that the percentage of adults with less than $1,000* in savings jumped from 62 percent in 2015 to 69 percent in 2016.

This year, GOBankingRates asked more than 8,000 Americans the same question again: “How much money do you have saved in your savings account?”

Respondents could choose one of the following answers:

- $0

- Less than $1,000

- $1,000-$4,999

- $5,000-$9,999

- $10,000 or more

This year, the results are both encouraging — and discouraging. Read on to find out how much Americans have in savings accounts.

Average American Savings: A Growing Percentage Have $0 Saved

Some Americans who are saving appear to be doing a better job of setting aside cash in a savings account. In the 2017 survey, 57 percent of respondents said they have less than $1,000* in a savings account — a decrease of 12 percentage points from 2016 and 5 percentage points from 2015.

In other words, 43 percent of Americans now have at least $1,000 or more set aside versus only 31 percent last year. In fact, 25 percent of Americans now say that they have $10,000 or more in saving, which is an increase of 10 percentage points from 2016.

This could suggest some Americans are beginning to realize the importance of having money saved, specifically in a savings account.

“Having cash in a savings account is important because life happens,” said Alex Whitehouse, president and CEO of Whitehouse Wealth Management in Vancouver, Wash. “Companies lay off employees, cars break down and people get sick. Without savings, unexpected spending forces people to take on debt, frequently using credit cards. At 16 percent or more interest, credit cards become a very costly way to handle sudden expenses.”

But here’s where the results get discouraging: A growing percentage of Americans have absolutely nothing set aside in a savings account. The new survey found that 39 percent of Americans have $0 saved — up from 34 percent in 2016.

That means more people are not financially prepared to protect themselves from one of the many financial disasters that can pop up.

Whitehouse said it’s not surprising that such a large percentage of people don’t have savings. “Unfortunately, many people are living paycheck to paycheck, struggling to pay off student loans and credit cards,” he said. “For those saddled with an enormous amount of debt, building savings can feel like climbing Everest.”

Average American Savings by Age: Older Americans Are Better at Saving

The average (or typical) American savings account balance varies greatly by age. However, one trend is clear from the 2017 survey responses: Savings account balances generally increase with age.

Millennials (ages 18 to 34) are more likely than other generations to have nothing saved. And adults 65 and older are more likely to have $10,000 or more in a savings account. Of course, time could play a role. Older adults have had more years to build their savings.

However, other factors could explain the disparity in savings accounts across generations.

More Millennials Have No Savings

In line with the overall survey results, millennials have gotten both better and worse at saving money. For example, a greater percentage of millennials now have $10,000 or more in savings. And, a smaller percentage have less than $1,000 in savings.

However, there’s a growing percentage of those who actually have nothing saved. Here’s a look at how much young millennials (ages 18 to 24) have in savings accounts this year compared to last year.

As you can see from the graphic above, the percentage of young adults with nothing in a savings account has jumped significantly — 15 percentage points, to be exact. But on the other end of the spectrum, some millennials seem to be taking steps to increase their savings account balances. From 2016 to 2017, the percentage of younger millennials who have $10,000 or more in a savings account has jumped 5 percentage points.

And what about older millennials, those ages 25 to 34? Their savings account balances demonstrate similar year-over-year trends as their younger counterparts.

Compared to younger millennials, the percentage of older millennials with $0 in a savings account is lower — and so is the year-over-year change. Still, there’s an increase of 8 percentage points among older adults who have nothing saved compared to last year’s survey.

However, some are getting better at saving. This year’s survey saw an increase of 5 percentage points among older millennials who have at least $10,000 in savings accounts, too.

So, why is it that a higher percentage of all millennials have nothing stashed in a savings account? It could be a combination of factors.

For example, young adults tend to have low starting salaries and a heavy student loandebt, which might be making it hard for them to build savings, said Whitehouse. In fact, GOBankingRates’ 2016 Debt survey found that 36 percent of 18- to 24-year-old millennials and more than 40 percent of 25- to 34-year-old millennials have student loan debt.

But, it might also come down to millennials’ saving and spending habits. A separate survey found about half of all millennials are living paycheck to paycheck. Even worse: 72 percent of young millennials and 61 percent of older millennials admit they currently don’t have enough money to cover six months of living expenses.

Generation X Catching Up on Savings

A greater percentage of Gen Xers have $0 in savings compared to last year. But, the increase isn’t as high as it is among millennials.

This year, 38 percent of younger Gen Xers (ages 35 to 44) have $0 saved, which is only an increase of 3 percentage points from 2016. And, there has been a marked decline in the percentage of those with less than $1,000 in savings. The percentage of young Gen Xers with less than $1,000 saved fell 18 percentage points this year.

But perhaps this is the most encouraging news: There has been a noticeable increase — 12 percentage points — of those with $10,000 or more stashed in a savings account.