![]()

New tool shows where property tax dollars go and informs fed up taxpayers

By Maria Pappas

When I saw how recent property tax bills shocked and angered many Cook County homeowners I knew people needed to understand why their taxes are so high.

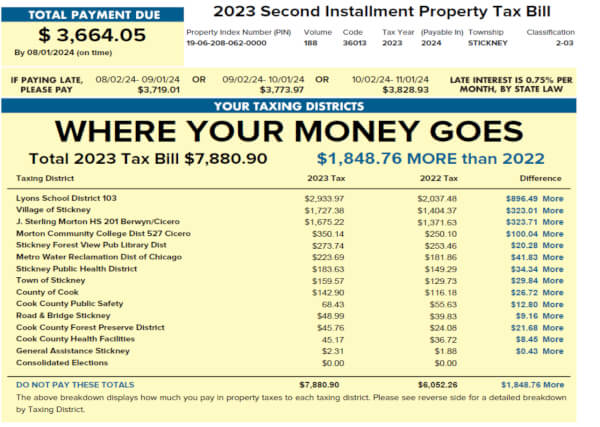

I began hearing from frustrated homeowners before tax bills landed in early November in their mailboxes. Many already had viewed and paid their bills online before they were mailed. The median residential tax bill in the north and northwest suburbs jumped 15.7% from the previous year. Still, most homeowners in other parts of Cook County also faced increases.

“My house is paid for, but with the taxes, it’s like having a whole new mortgage all over again,” Maria Sams of Midlothian told NBC5 Chicago during one of many news reports about my office’s analysis of 1.8 million tax bills.

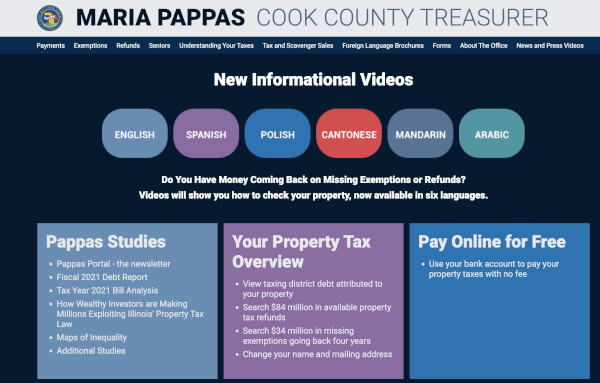

To help people understand their tax bills, my office created the new “Where Your Money Goes” dashboard at cookcountytreasurer.com. You can find this helpful resource by clicking on “Your Property Tax Overview” in the purple box on the homepage.

You can search by address or Property Index Number (PIN) and see how your new tax bill compares to last year’s. You also will see how much of your hard-earned money goes to each local taxing body, such as schools, parks or library districts and whether you are paying more or less to each of those agencies.

The more you understand about the property tax system the better able you are to save money on your tax bills. My office educates property owners about exemptions, which are tax breaks that create savings for homeowners, senior citizens and others. I have published brochures and a property tax primer, as well as made videos and conducted outreach to teach people about the complexities of assessments, equalizers, tax rates and other parts of the sprawling tax system.

A big part of the system, and one that invites public input every year, is the tax levy. A levy is the amount of money a school district or other taxing body intends to collect in property taxes. Boards that govern taxing districts must hold public hearings before adopting an annual levy. This gives homeowners a chance to tell their local elected officials what they think about the amount of taxes they have to pay.

Many taxing bodies are approving levies this time of year, yet few taxpayers attend these public hearings. Levies are a big reason why taxes increase from one year to the next. Schools typically account for two-thirds or more of your property taxes. If elected officials heard from taxpayers firsthand, they might work harder to keep tax levies as low as possible by looking for ways to reduce costs by operating more efficiently.

Property taxes are higher in Illinois than most other states because Illinois relies more heavily on property taxes to fund education and pay down public pension debt. Homeowners seeking solutions to high property taxes should contact their state lawmakers and let them know what they think about paying such high property taxes.

Homeowners who want to do something about property taxes should first check that they are getting all the tax breaks to which they are entitled. Then they should pay attention to where their property tax dollars go and seek accountability from their elected officials.

- Dad reunited with young daughter after ex-wife obtained baseless Order of Protection against him - May 24, 2024

- Word of mouth helps homeowner get $6,805 refund for missed exemptions - March 5, 2024

- Lonely fathers need to take steps to end epidemic and provide good examples to their children - March 5, 2024

Comment on “New tool shows where property tax dollars go and informs fed up taxpayers”