Kaegi praises legislative adoption of affordable housing tax relief law

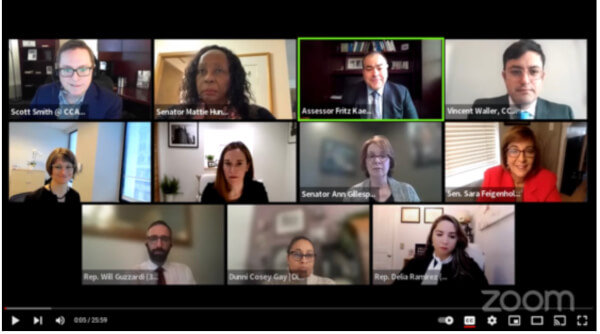

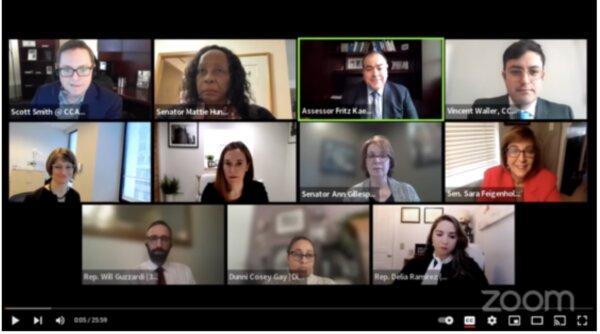

Assessor Fritz Kaegi was joined by state legislators and affordable housing advocates today to launch the Affordable Housing Special Assessment Program, a new form of property tax relief that was recently signed into law.

Assessor Kaegi worked with legislative partners who passed the law in the spring of 2021, including State Sens. Sara Feigenholtz, Ann Gillespie, and Mattie Hunter and State Reps. Will Guzzardi and Delia Ramirez. Community housing advocates Allison Clements, executive director of the Illinois Housing Council, and Stacie Young, President and CEO of Community Investment Corporation, along with other affordable housing supporters, advocated for the change to the law and worked to craft the language for it.

In a press conference, Assessor Kaegi, legislators, and advocates discussed how affordable housing property owners could apply for this new type of property tax relief and how they, as well as tenants, will benefit from it.

“Without this coalition of leaders and organizers, we would not have been able to take this important step toward encouraging more affordable housing in Cook County,” said Assessor Kaegi. “The implementation of this law by my office will clear the way for property tax relief for developers who create and maintain this valuable housing category, and will expand the availability of rental units for low-income households.”

|

The Assessor’s Office is asking potential applicants to apply by March 31, 2022. Interested parties can visit cookcountyassessor.com/affordable-housing to access the application and read more information.

A series of webinars about the Affordable Housing Special Assessment Program will take place in February and March for those who provide and utilize affordable housing. The first webinar will focus on properties that have previously taken advantage of Cook County’s Class 9 incentive program. The date for this first webinar will be Tuesday, February 15, 2022. Attendees can sign up by emailing assessor.affordablehousing@cookcountyil.gov. Future webinars will focus on institutional-grade properties, naturally occurring affordable housing, and low-affordability communities.

“One of Illinois’ biggest challenges has always been affordable housing, which was amplified during the pandemic,” said Sen. Feigenholtz. “Providing incentives to local mom-and-pop landlords and new developments to keep rent affordable for future and existing tenants was the goal of this legislation.”

“Creating options for working families in every neighborhood will diversify and grow our communities in a way that works for everyone, not just those with wealth,” Sen. Gillespie said. “I encourage local developers to apply for this program so we can build an equitable future of housing for all Illinoisans in every corner of the state.”

“Affordable housing is an essential right that needed to be addressed long before the pandemic, and I am glad that much-needed change is coming to fruition,” said Sen. Hunter, Majority Caucus Chair. “This measure will help families stay in their homes. I am proud of the work we’ve done and I hope that affordable and equitable options prevail long after the COVID-19 pandemic is gone.”

“This new program is a critical policy tool that will incentivize investment in affordable rental housing across all types of communities,” said Allison Clements, executive director of the Illinois Housing Council. We appreciate the collaboration of the Cook County Assessor’s Office to ensure a successful implementation of the program.”

Created by state statute, this exciting new program provides property tax relief to incentivize the creation, rehabilitation, and maintenance of affordable housing units in Cook County for eligible applicants, beginning with the 2022 assessment year.

“We need to use every tool at our disposal to encourage the creation and preservation of affordable housing in our communities,” said Rep. Will Guzzardi. “Assessor Kaegi’s implementation of our legislation in Springfield will incentivize developers and housing providers to keep units affordable at a time when renters desperately need it. I’m grateful to Fritz and his team for their leadership on equity and affordability.”

“We had a historic session last year advancing housing issues in the General Assembly,” said Rep. Ramirez, House Assistant Majority Leader. “This new property tax relief program for those who develop and maintain affordable housing was a key component of our comprehensive affordable housing legislation. This program will help Illinois continue to lead on making housing accessible and affordable for all.

While similar to existing housing incentives, this new program provides improved benefits for housing providers as well as low-income households by providing more expansive property tax benefits, more ways to qualify, and by encouraging the development of affordable housing in low affordability communities.

“Thanks to many partners working together, this is one of the rare housing policies that works across different markets and building types – including the unsubsidized, naturally occurring affordable housing which comprises the vast majority of the affordable rental stock here and across the country,” said Stacie Young, President, and CEO of Community Investment Corporation.

The applications for the program are available now. To apply, and for more information on the Affordable Housing Special Assessment Program, visit cookcountyassessor.com/affordable-housing.