Social Security to increase slightly over 2018

Social Security Announces 2.8 Percent Benefit Increase for 2019

Social Security and Supplemental Security Income (SSI) benefits for more than 67 million Americans will increase 2.8 percent in 2019, the Social Security Administration announced today.

The 2.8 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 62 million Social Security beneficiaries in January 2019. Increased payments to more than 8 million SSI beneficiaries will begin on December 31, 2018. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor’s Bureau of Labor Statistics.

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $132,900 from $128,400.

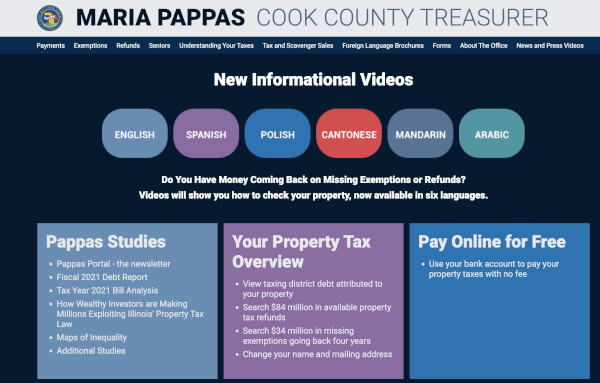

Social Security and SSI beneficiaries are normally notified by mail in early December about their new benefit amount. This year, for the first time, most people who receive Social Security payments will be able to view their COLA notice online through their my Social Security account. People may create or access their my Social Security account online at www.socialsecurity.gov/myaccount.

Information about Medicare changes for 2019, when announced, will be available at www.medicare.gov. For Social Security beneficiaries receiving Medicare, Social Security will not be able to compute their new benefit amount until after the Medicare premium amounts for 2019 are announced. Final 2019 benefit amounts will be communicated to beneficiaries in December through the mailed COLA notice and my Social Security’s Message Center.

The Social Security Act provides for how the COLA is calculated. To read more, please visit www.socialsecurity.gov/cola.

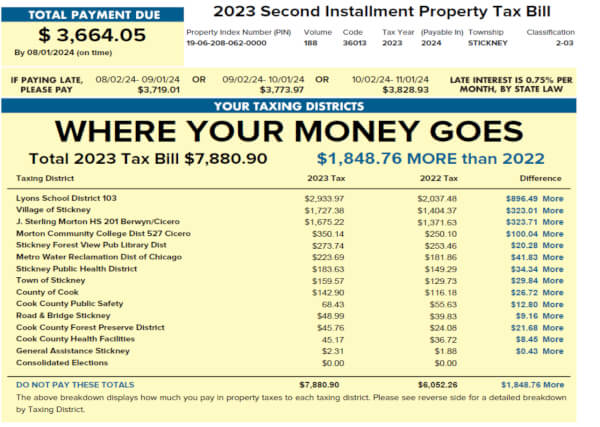

Here is a chart of the Social Security Benefits:

2019 SOCIAL SECURITY CHANGES

Cost-of-Living Adjustment (COLA):

Based on the increase in the Consumer Price Index (CPI-W) from the third quarter of 2017 through the third quarter of 2018, Social Security and Supplemental Security Income (SSI) beneficiaries will receive a 2.8 percent COLA for 2019. Other important 2019 Social Security information is as follows:

| Tax Rate | 2018 | 2019 |

| Employee | 7.65% | 7.65% |

| Self-Employed | 15.30% | 15.30% |

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings. Also, as of January 2013, individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) pay an additional 0.9 percent in Medicare taxes. The tax rates shown above do not include the 0.9 percent.

| 2018 | 2019 | |

| Maximum Taxable Earnings | ||

| Social Security (OASDI only) | $128,400 | $132,900 |

| Medicare (HI only) | No Limit | |

| Quarter of Coverage | ||

| $1,320 | $1,360 | |

| Retirement Earnings Test Exempt Amounts | ||

| Under full retirement age | $17,040/yr.

($1,420/mo.) |

$17,640/yr.

($1,470/mo.) |

| NOTE: One dollar in benefits will be withheld for every $2 in earnings above the limit. | ||

| The year an individual reaches full retirement age | $45,360/yr.

($3,780/mo.) |

$46,920/yr.

($3,910/mo.) |

| NOTE: Applies only to earnings for months prior to attaining full retirement age. One dollar in benefits will be withheld for every $3 in earnings above the limit. | ||

| Beginning the month an individual attains full retirement age. | None | |

| 2018 | 2019 | |||

| Social Security Disability Thresholds | ||||

| Substantial Gainful Activity (SGA) | ||||

| Non-Blind | $1,180/mo. | $1,220/mo. | ||

| Blind | $1,970/mo. | $2,040/mo. | ||

| Trial Work Period (TWP) | $ 850/mo. | $ 880/mo. | ||

| Maximum Social Security Benefit: Worker Retiring at Full Retirement Age | ||||

| $2,788/mo. | $2,861/mo. | |||

| SSI Federal Payment Standard | ||||

| Individual | $ 750/mo. | $ 771/mo. | ||

| Couple | $1,125/mo. | $1,157/mo. | ||

| SSI Resource Limits | ||||

| Individual | $2,000 | $2,000 | ||

| Couple | $3,000 | $3,000 | ||

| SSI Student Exclusion | ||||

| Monthly limit | $1,820 | $1,870 | ||

| Annual limit | $7,350 | $7,550 | ||

| Estimated Average Monthly Social Security Benefits Payable in January 2019 | ||||

| Before

2.8% COLA |

After

2.8% COLA |

|||

| All Retired Workers | $1,422 | $1,461 | ||

| Aged Couple, Both Receiving Benefits | $2,381 | $2,448 | ||

| Widowed Mother and Two Children | $2,797 | $2,876 | ||

| Aged Widow(er) Alone | $1,348 | $1,386 | ||

| Disabled Worker, Spouse and One or More Children | $2,072 | $2,130 | ||

| All Disabled Workers | $1,200 | $1,234 | ||