Click here to subscribe FREE to Ray Hanania's Columns

Illinois sees 7th highest in total household debt, ranks 29th in debt rise

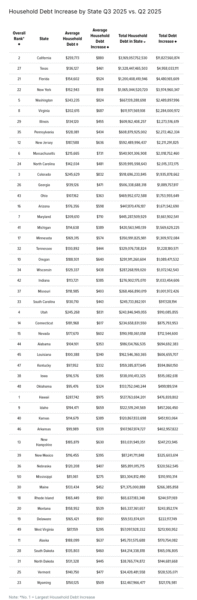

With household debt reaching $18.59 trillion in Q3 2025, the personal-finance company WalletHub today released its rankings of the States With the Largest & Smallest Debt Increases, based on new data from TransUnion and the Federal Reserve, to highlight where people may be in financial danger.

Access to the wide variety of loan products on the market today has made it easier for Americans to purchase what they need when they need it.

This convenience comes with a price, though. Not only do loans charge interest rates and fees, but they also add to your overall debt load, which can hurt your credit score.

With household consumer debt reaching $18.59 trillion nationwide in the third quarter of 2025, it’s clear that Americans are leveraging the loan opportunities available today.

While consumers in some states are adding to their debt at an alarming rate, others are contributing less to the nationwide debt increase. To determine the states with the largest and smallest household debt increases.

WalletHub compared the 50 states based on the latest data available from TransUnion and the Federal Reserve from Q2 2025 to Q3 2025.

With household debt reaching $18.59 trillion in Q3 2025, the personal-finance company WalletHub today released its rankings of the States With the Largest & Smallest Debt Increases, based on new data from TransUnion and the Federal Reserve, to highlight where people may be in financial danger.

| Largest Average Household Debt Increase |

Smallest Average Household Debt Increase |

| 1. Hawaii | 41. Michigan |

| 2. California | 42. Indiana |

| 3. Colorado | 43. Ohio |

| 4. Utah | 44. Alabama |

| 5. Washington | 45. Louisiana |

| 6. Massachusetts | 46. Arkansas |

| 7. Maryland | 47. Kentucky |

| 8. Virginia | 48. Oklahoma |

| 9. Idaho | 49. West Virginia |

| 10. Oregon | 50. Mississippi |

For the full report, please visit:

https://wallethub.com/edu/debt-changes-by-state/129889

National Stats

- Q3 Results: Total household debt increased by $69 billion during Q3 2025. That is 19% less than the increase in Q3 2024.

- Household Average: The average household owed a total of $154,152 at the end of Q3 2025, which is $13,466 below the all-time high.

- Total Debt-to-Deposits Ratio: The ratio of total household debt to deposits indicates consumers are in a stable position. It’s still below pre-Covid levels and roughly 46% lower than the early-2000s peak.

- Total Debt-to-Assets: The ratio between total household debt and assets, at 9.36%, continues to be at a very healthy level.

Click here to subscribe FREE to Ray Hanania's Columns

- Moderate Jewish Lobby J Street denounces Trump war on Iran - February 28, 2026

- Sean Casten Statement on US Military Action in Iran - February 28, 2026

- Phil Andrew: Attack on Iran Without Congressional Approval Risks American Lives - February 28, 2026