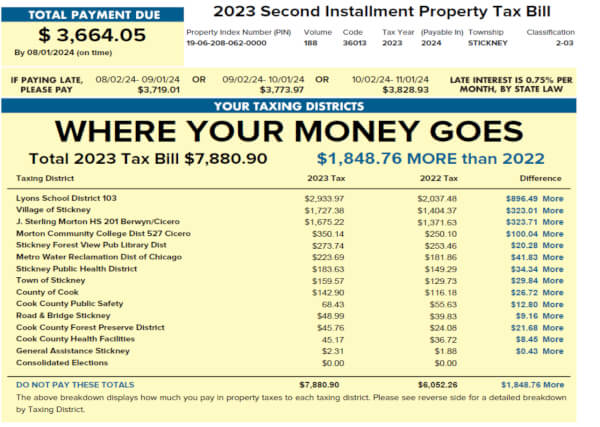

Money from your property taxes pays for essential local services

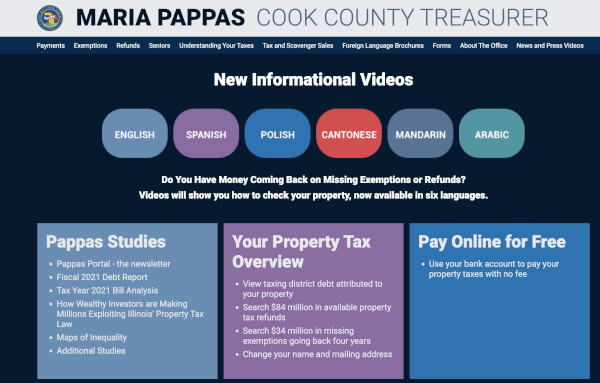

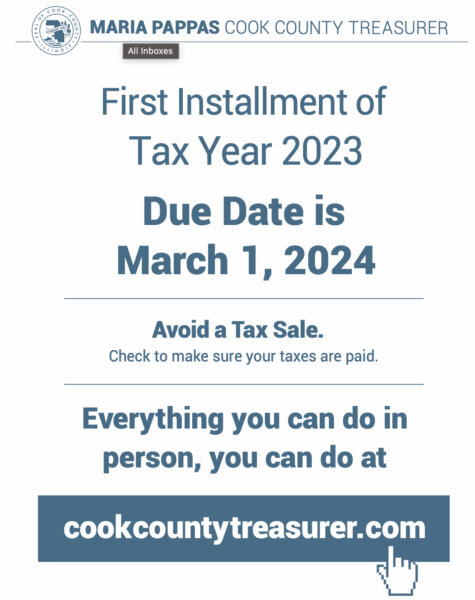

Your Property Taxes with Cook County Treasurer Maria Pappas

By Maria Pappas

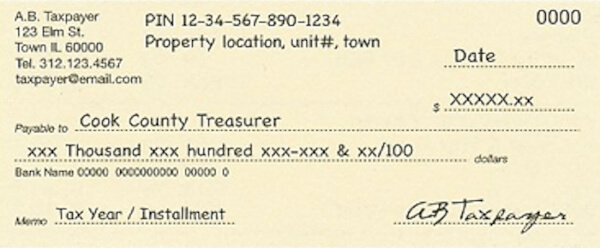

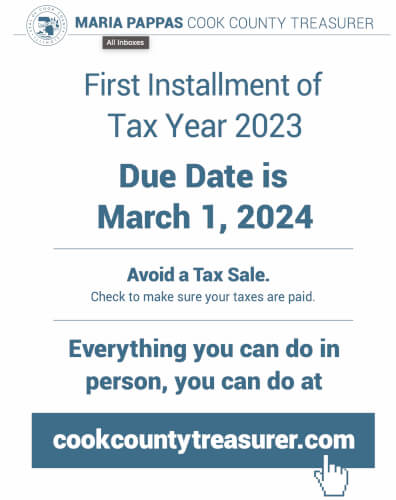

My office recently mailed property tax bills to owners of nearly 1.8 million parcels in Cook County. First Installment tax bills are due March 1.

Local governments, such as school districts and municipalities, count on my office to collect about $18 billion a year from property owners. We then distribute funds to about 2,200 units of government. That money helps pay for public education, police protection and other essential services.

In Illinois, local units of government set levies that determine how much revenue they intend to collect from property taxes each year. The total amount of the levy is spread among all the properties within the boundaries of a taxing district. Each taxpayer owes an amount based on the value of their property.

The assessor determines property values. Owners can appeal their assessments to the assessor, then to the Cook County Board of Review. They can appeal the Board of Review’s decision to the Illinois Property Tax Appeals Board or state courts.

The county clerk’s role in the property tax system is to determine tax rates that are based on levies set by local governments. The clerk applies the rates to the assessed values of properties to determine how much each property owner owes.

The steps outlined in these few paragraphs summarize the Illinois Property Tax Code. The Tax Code is state law that contains more than 200,000 words that would fill more than 400 standard pages. The Tax Code is complex, which makes it hard for people to understand the property tax system and where their money goes.

In addition to appealing their assessments, homeowners can potentially reduce their tax bills by checking for missed exemptions or past overpayments. The county could potentially refund nearly $150 million to taxpayers. We’ve identified nearly $93 million in duplicate or overpayments that could be refunded and another $57 million in possible missed exemptions.

Exemptions are tax breaks that lower tax bills. The most common exemptions are Homeowner, Senior Citizen and Senior Freeze. Many taxpayers are unaware they may be eligible for exemptions that significantly reduce their tax bills and potentially earn them refunds.

I urge you to visit our website, cookcountytreasurer.com, and click on the purple box that says Your Property Tax Overview. Search for your property using your address or Property Index Number, and a picture of your property should appear so you know you’ve got the right place.

You can use the website to:

- Download a copy of your bill and pay your taxes electronically

- View a 20-year history of your property taxes

- Search for possible overpayments or missed exemptions

- Discover how much taxing district debt is linked to your property

- Learn how much your taxing districts owe for public pensions, and more.

Property taxes are critical sources of funding for essential local services.

The property tax system is complex, but homeowners who invest the time to better understand their tax bills are more likely to save themselves money by capturing tax breaks for which they are eligible.