Click here to subscribe FREE to Ray Hanania's Columns

Loop’s declining value fuels record 16.7% jump in median property tax bill for Chicago homeowners

Homeowners in Black communities hit with biggest percentage increases

A dramatic decline in the value of commercial property in Chicago’s Loop, the city’s longtime economic engine, fueled a record property tax increase on homes across the city, according to an analysis released today by Cook County Treasurer Maria Pappas.

The amount of taxes imposed on Loop commercial properties — office buildings, retail stores, hotels and restaurants — for tax year 2024, decreased by more than $129 million because of a significant drop in their values.

Property taxes are a zero-sum game. So, when one group of property owners pays a smaller share of an ever-increasing overall tax bill, others whose property values remain level or rise pay more.

For tax year 2024, Chicago homeowners will pay $469.4 million more than they did the year before, because of the tax shift from commercial to other properties and Chicago Public Schools and other local governments asking for half-a-billion dollars more than they did a year earlier. CLICK HERE TO READ THE PDF REPORT

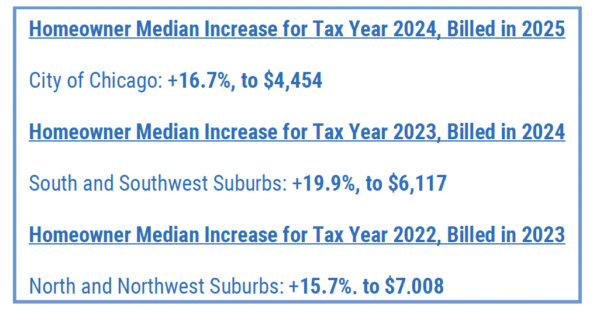

The median residential tax bill in the city rose 16.7%, to $4,457 — the largest percentage city increase in at least 30 years. It also marks the third year in a row when a reassessed area of Cook County saw record median tax bill increases for homeowners, largely due to commercial values falling while residential values rose.

Particularly hard hit were homeowners in poorer, predominantly Black areas on the city’s South and West sides, where home values have soared since the COVID-19 pandemic. Median residential bills in nine community areas went up by more than 50%, with three topping 80%:

• In West Garfield Park, the median homeowner tax bill increased by nearly $2,000, or 133%.

• In North Lawndale, it increased by nearly $1,900, or 99%.

• In Englewood, the increase came to $609, or 82.5%.

“When the Loop gets a cold, the rest of the city gets pneumonia,” Pappas said. “Homeowners across the city are paying the price. I’m particularly concerned about how lower-income homeowners in struggling communities are going to be able to pay their bills.”

That sticker shock, and how it came about, is documented by Pappas’ research team in its Tax Year 2024 Bill Analysis, an examination of nearly 1.8 million bills that were mailed to property owners Nov. 14 and are due Dec. 15.

Owners of large apartment buildings and complexes, as well as owners of industrial facilities, were not spared from this year’s tax shift. Multifamily properties, those with six or more units, must pay an extra $100.5 million, while industrial property owners must pay $73.5 million more. That’s compared to commercial property owners across the city paying $134.4 million less in taxes.

Chicago was reassessed in 2024 for this year’s bills, which triggered the shift in tax burden from commercial properties onto others, as overall taxes in the city grew by $528.6 million, or 6.3%. Less sticker shock likely will be felt in the city’s suburbs, which were reassessed in prior years.

In the suburbs north of North Avenue, which are now being reassessed for next year’s bills, taxes rose by a total of $209.4 million, or 3.7%. The increase in taxes on both businesses and homeowners rose by less than 4%. However, the median bill for businesses grew at a faster pace: 4.6% versus 3.4% for homes.

After being hit with a record 19.9% increase in their median residential tax bill last year, homeowners south of North Avenue will get something of a break, with a median increase of 2.2%. Businesses face a median increase of 3.1%.

Across Cook County, taxes rose by almost $871.8 million to nearly $19.2 billion, or 4.8%, well above the 3.5% inflation rate for 2024.

This is at least the 30th consecutive year that property taxes rose across the county — the result of schools and local governments like municipalities, the county, sanitary districts, library districts, park districts and fire districts — asking for more money from property owners.

Also adding to property owners’ financial burdens were increases in Tax Increment Financing district taxes and those imposed under the state’s recapture law. The law allows school districts and some local governments to increase their levies by the amount refunded to taxpayers in the previous year as the result of bill adjustments.

The yearly tax bill analysis is the latest addition to the Pappas Studies, a series of examinations of the complex property tax system available at cookcountytreasurer.com.

Property owners who don’t want to wait for their bills to arrive in the mail can pay their taxes online now at cookcountytreasurer.com. Partial payments are accepted.

Click here to subscribe FREE to Ray Hanania's Columns

- Dad Wins Custody of Son After Terrifying DCFS Call - March 5, 2026

- Moderate Jewish Lobby J Street denounces Trump war on Iran - February 28, 2026

- Sean Casten Statement on US Military Action in Iran - February 28, 2026