Rauner blocks legislative rape of suburban taxpayers

Once again the Illinois Legislature is stepping in to bailout wasteful spending and mismanagement at the Chicago Public Schools but forcing suburban taxpayers to pay extra to cover the city’s debt. Instead of making Chicago residents pay for their own failed institutions, the Chicago controlled legislature is forcing suburbanites to bailout the city

By Ray Hanania

The Chicago Public schools are the worst managed schools in the country, milking the taxpayers. Not only are Chicago schools dangerous and crime-infested, but the Chicago schools do a poor job of educating their students, with most of the system’s funding used to pay excessive salaries to politically backed teachers.

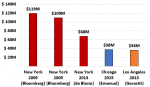

The Chicago Board of Education has a massive debt of more than $17 billion and this week, they helped push through legislation that would put the majority of the burden of repaying the debt on the backs of suburban taxpayers.

Chicago spends more on its students than any other school system in Illinois, more than $17,266 per pupil in 2016, according to the Illinois State Board of Education. The state average is only $12,821 and reflects the amount spent on suburban school students.

But the legislature is changing the school funding system which oversees taxes collected from homeowners to pay for local schools. But instead of using the money to fund local schools, the legislature is taking the bulk of monies from suburban taxes and earmarking them to bailout the corrupt Chicago public schools system.

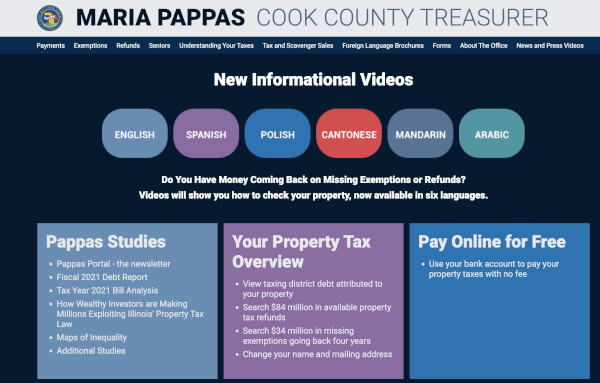

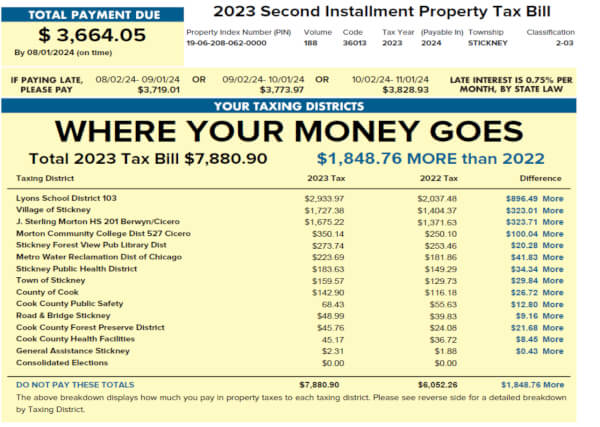

The theft of money from the suburbs is a trend that we see in Chicago-controlled government in Cook County. Cook County is controlled by Chicago politicians, even though half the residents live int he suburbs. But the County’s districts are drawn to dilute the strength of suburban voters and allow Chicago voters, and their Chicago based elected county board commissioners, to dominate the county board and its vote.

As a consequence, Chicago politicians control tax collections and revenue spending, with most of the money being redirected to pay for the waste and corruption that has resulted in poor services for Chicago residents. Nearly half of the taxes collected in suburban Cook County are used to pay for services in Chicago. Suburban residents are left at the end of the line and often excluded from receiving financial support.

In otherwords, most of the taxes taken from suburban homeowners are used to fund debts and mismanagement in Chicago.

The trend is clear. Recently, former Chicago Machine Alderman Toni Preckwinkle, who is now the president of the Cook County Board, imposed a 1 cent per ounce sales tax on all sweetened soft drinks. Excluded from the tax are low income residents, 80 percent of whom live in Chicago and not in the suburbs.

The Preckwinkle tax has angered suburban voters and revived calls for Cook County to be divided to separate suburbanites from the waste and corruption that dominates the Chicago portion of Cook County.

Ironically, the system is rigged so that while Chicago politicians control Cook County spending, the county has less influence over Chicago’s poor record in fighting crime.

Cook County’s suburbs are forced to pay for the mistakes and the corruption in Chicago.

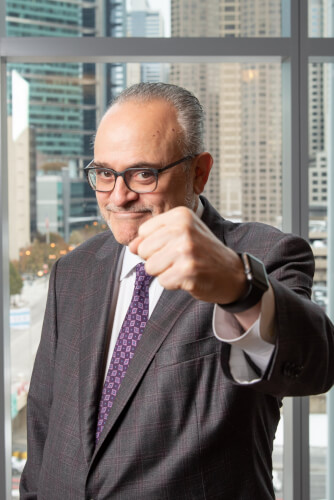

Gov. Bruce Rauner has vetoed the most recent effort to rape the suburban taxpayers and he deserves applause for his stand.

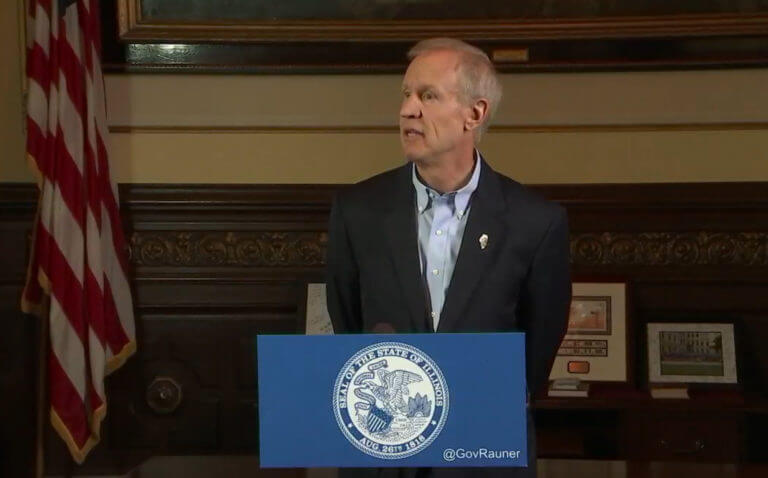

Click here to view Gov. Rauner’s press conference detailing how he is preventing Chicago from raping suburban taxpayers.

Here is Gov. Rauner’s press release:

Today, Gov. Bruce Rauner issued an amendatory veto to Senate Bill 1, the school funding bill. The matter now heads to the Illinois General Assembly, where the governor has respectfully requested that lawmakers uphold his changes. If these changes are upheld, Illinois will achieve historic education funding reform.

“It doesn’t matter where you come from or who your family is. With a great education, you can go anywhere in life and be whomever you want to be. You can grow up, get a good job and provide for your family. That’s why the changes I have made to the education funding bill are so important,” Gov. Rauner said. “With my changes, our state ensures that enough resources flow to children in the poorest and most disadvantaged school districts across the entire state. And my changes ensure that the education funding system in our state is fair and equitable to all students in Illinois.”

More than a year ago, Gov. Rauner established the Illinois School Funding Reform Commission. This group came together on a bipartisan basis to study the way Illinois funds its public schools, and to chart a path to a fairer and more equitable system.

“These changes included in my amendatory veto reflect years of hard work by our education reform commission and our ability to overcome our political differences for the good of our young people’s futures,” Gov. Rauner said. “I urge the General Assembly to act quickly to accept these changes and let our students start school on time.”

The governor’s amendatory veto makes the following changes to ensure an adequate and equitable school funding formula:

- Maintains a per-district hold harmless until the 2020-2021 school year, and then moves to a per-pupil hold harmless based on a three-year rolling average of enrollment.

- Removes the minimum funding requirement. While the governor is committed to ensuring that the legislature satisfies its duty to fund schools, the proposed trigger of one percent of the overall adequacy target plus $93 million artificially inflates the minimum funding number and jeopardizes Tier II funding.

- Removes the Chicago block grant from the funding formula.

- Removes both Chicago Public Schools pension considerations from the formula: the normal cost pick-up and the unfunded liability deduction.

- Reintegrates the normal cost pick-up for Chicago Public Schools into the Pension Code where it belongs, and finally begins to treat Chicago like all other districts with regards to the State’s relationship with its teachers’ pensions.

- Eliminates the PTELL and TIF equalized assessed value subsidies that allow districts to continue under-reporting property wealth.

- Removes the escalators throughout the bill that automatically increase costs.

- Retains the floor for the regionalization factor, for the purposes of equity, and adds a cap, for the purposes of adequacy.

The amendatory veto also removes the accounting for future pension cost shifts to districts in the Adequacy Target. This prevents districts from ever fully taking responsibility for the normal costs of their teachers’ pensions.

A copy of Gov. Rauner’s amendatory veto letter is attached.

Here is Gov. Rauner’s Veto Letter to the Illinois Legislature:

August 1, 2017

To the Honorable Members of The Illinois Senate, 100th General Assembly:

Today, I return Senate Bill 1 with specific recommendations for change that will set Illinois students and schools on a brighter path with a fairer funding system. This historic moment will help generations of Illinois children, and reflects the hard work and recommendations of the bipartisan Illinois School Funding Reform Commission.

The changes submitted to SB 1 prioritize critical education funding reform and give schools the resources they need to provide the best education to our students across the state. As written, SB 1 aligns in many ways with the Commission’s recommendations.

This includes requiring that every school district receive an individualized adequacy target reflecting students’ needs and educational best practices; that every school district receive a local capacity target to guide their local contributions toward equitable funding; that the distribution of any new funds prioritize those school districts farthest away from adequacy; and that, as a matter of student centered equity, district authorized charter schools receive funding parity. Unfortunately, several provisions within the bill worked against the Commission’s recommendations and the purpose of providing fair funding for all our students across the state. Where the Commission unanimously recommended a per-pupil hold harmless, Senate Bill 1 fixes a per-district hold harmless in perpetuity.

By freezing all districts’ base funding at an arbitrary moment in time, it limits the state’s ability to reflect fluctuations in enrollment and better target available money to students in need. Senate Bill 1 includes a regionalization factor but places an artificial floor on it, driving up costs and exacerbating our state’s already-significant distance from adequacy.

Senate Bill 1 also establishes an unsustainable minimum funding level that, if not met, triggers a shift of all new state resources to Tier I districts at the expense of Tier II districts. As written, Senate Bill 1 places the burden of the Chicago Public Schools’ broken teacher pension system on our rural and suburban school districts through three major provisions: pick-up of CPS’ normal pension costs, retention of the so-called Chicago block grant, and a deduction for the CPS unfunded pension liability.

Taken together, these three provisions put Chicago in line for millions more in funding that are diverted from other, needier districts, thus going against the Commission recommendation that any additional money be distributed first to districts farthest from adequacy. This is not about taking resources away from Chicago. This is about making historic changes to help poor children in Chicago and throughout the state of Illinois.

Moreover, the pension provisions in SB1 tack on last-minute additions to a formula never designed to solve a pension crisis. CPS’ pension crisis should be resolved in a separate forum that also addresses statewide pension reform. To move toward treating all school districts in the state the same, this amendatory veto continues to fund CPS’ normal pension costs but shifts that funding out of the school funding formula.

This ensures that new money going into the formula can achieve the stated goals of going first to the districts that need it most. A number of changes to this bill are needed to return PK-12 funding reform to the original spirit of the Commission and its commitment to promote equity and adequacy statewide.

The first change will maintain a per-district hold harmless until the 2020-2021 school year and then move to a per pupil hold harmless based on a three-year rolling average of enrollment.

The second change will remove the minimum funding requirement; while I am committed to ensuring that the legislature satisfies its duty to fund schools, the proposed trigger of one percent of the overall adequacy target plus $93 million artificially inflates the minimum funding number and jeopardizes Tier II funding.

The third change will remove the Chicago block grant from the funding formula.

The fourth change will remove both Chicago Public Schools pension considerations from the formula: the normal cost pick-up and the unfunded liability deduction.

The fifth change will reintegrate the normal cost pickup for Chicago Public Schools into the Pension Code where it belongs, and will finally begin to treat Chicago like all other districts with regards to the State’s relationship with its teachers’ pensions.

The sixth change will Eliminate the PTELL and TIF equalized assessed value subsidies that allow districts to continue under-reporting property wealth.

The seventh change will remove the escalators throughout the bill that automatically increase costs.

The eighth change removes the accounting for future pension cost shifts to districts in the Adequacy Target. This provision would prevent districts from ever fully taking responsibility for the normal costs of their teachers’ pensions.

The final change will retain the floor for the regionalization factor, for the purposes of equity, and will add a cap, for the purposes of adequacy. The changes recommended here and the adoption thereof would transform our great state’s ability to provide an equitable and adequate education for all children.

Therefore, pursuant to Article IV, Section 9(e) of the Illinois Constitution of 1970, I hereby return Senate Bill 1, entitled, “An ACT concerning education,” with the following specific recommendations for change: On page 3, by replacing lines 8 through 10 with: “formula, provided for in Section 18-8 of the School Code, until such time as all economic”; and On page 17, by replacing lines 1 and 2 with the following: “Section 17. The Illinois Pension Code is amended by changing Sections 16-158 and 17-127 as follows:”; and On page 32, immediately after line 24, by inserting the following: “(40 ILCS 5/17-127) (from Ch. 108 1/2, par. 17-127) Sec. 17-127. Financing; revenues for the Fund.

(a) The revenues for the Fund shall consist of: (1) amounts paid into the Fund by contributors thereto and from employer contributions and State appropriations in accordance with this Article; (2) amounts contributed to the Fund by an Employer; (3) amounts contributed to the Fund pursuant to any law now in force or hereafter to be enacted; (4) contributions from any other source; and (5) the earnings on investments.

(b) The General Assembly finds that for many years the State has contributed to the Fund an annual amount that is between 20% and 30% of the amount of the annual State contribution to the Article 16 retirement system, and the General Assembly declares that it is its goal and intention to continue this level of contribution to the Fund in the future.

(c) Beginning in State fiscal year 1999 and ending at the end of State fiscal year 2017, the State shall include in its annual contribution to the Fund an additional amount equal to 0.544% of the Fund’s total teacher payroll; except that this additional contribution need not be made in a fiscal year if the Board has certified in the previous fiscal year that the Fund is at least 90% funded, based on actuarial determinations. These additional State contributions are intended to offset a portion of the cost to the Fund of the increases in retirement benefits resulting from this amendatory Act of 1998.

(d) In addition to any other contribution required under this Article, the State shall contribute to the Fund the following amounts: (1) For State fiscal year 2018, the State shall contribute $221,300,000. (2) Beginning in State fiscal year 2019, the State shall contribute for each fiscal year an amount to be determined by the Fund, equal to the employer normal cost for that fiscal year for all teachers hired before the implementation date of the plan created under Section 1-161 of the Illinois Pension Code for the retirement system under Article 16 or before the resolution or ordinance date under Section 1-162 of the Illinois Pension Code for the retirement System under Article 17, whichever is earlier, plus the amount allowed pursuant to paragraph (3) of Section 17-142.1, to defray health insurance costs for all employees.

The amount contributed under this paragraph (2) shall be reduced by the employer normal cost of the increase in benefits associated with the portion of salary in excess of the amount of the salary set for the Governor.

(e) The Board shall determine the amount of State contributions required for each fiscal year on the basis of the actuarial tables and other assumptions adopted by the Board and the recommendations of the actuary. On or before November 1 of each year, beginning November 1, 2017, the Board shall submit to the State Actuary, the Governor, and the General Assembly a proposed certification of the amount of the required State contribution to the Fund for the next fiscal year, along with all of the actuarial assumptions, calculations, and data upon which that proposed certification is based. On or before January 1 of each year, beginning January 1, 2018, the State Actuary shall issue a preliminary report concerning the proposed certification and identifying, if necessary, recommended changes in actuarial assumptions that the Board must consider before finalizing its certification of the required State contributions.

(f) On or before January 15, 2018 and each January 15 thereafter, the Board shall certify to the Governor and the General Assembly (i) the amount of the required State contribution for the next fiscal year and (ii) the amount by which the required State contribution was reduced pursuant to paragraph (2) of subsection (d) of this Section. The certification shall include a copy of the actuarial recommendations upon which it is based and shall specifically identify the Fund’s projected employer normal cost for that fiscal year. The Board’s certification must note any deviations from the State Actuary’s recommended changes, the reason or reasons for not following the State Actuary’s recommended changes, and the fiscal impact of not following the State Actuary’s recommended changes on the required State contribution. For the purposes of this Article, including issuing vouchers, and for the purposes of subsection (h) of Section 1.1 of the State Pension Funds Continuing Appropriation Act, the State contribution specified for State fiscal year 2018 shall be deemed to have been certified, by operation of law and without official action by the Board or the State Actuary, in the amount provided in subsection (d) of this Section.

(g) Beginning in State fiscal year 2018 on the 15th day of each month, or as soon thereafter as may be practicable, the Board shall submit vouchers for payment of State contributions to the Fund, in a total monthly amount of one-twelfth of the required annual State contribution under subsection (d). These vouchers shall be paid by the State Comptroller and Treasurer by warrants drawn on the funds appropriated to the Fund for that fiscal year. If in any month the amount remaining unexpended from all other State appropriations to the Fund for the applicable fiscal year is less than the amount lawfully vouchered under this subsection, the difference shall be paid from the Common School Fund under the continuing appropriation authority provided in Section 1.1 of the State Pension Funds Continuing Appropriation Act. Section 18.

The State Pension Funds Continuing Appropriation Act is amended by changing Section 1.1 as follows: (40 ILCS 15/1.1) Sec. 1.1. Appropriations to certain retirement systems. (a) There is hereby appropriated from the General Revenue Fund to the General Assembly Retirement System, on a continuing monthly basis, the amount, if any, by which the total available amount of all other appropriations to that retirement system for the payment of State contributions is less than the total amount of the vouchers for required State contributions lawfully submitted by the retirement system for that month under Section 2-134 of the Illinois Pension Code. (b) There is hereby appropriated from the General Revenue Fund to the State Universities Retirement System, on a continuing monthly basis, the amount, if any, by which the total available amount of all other appropriations to that retirement system for the payment of State contributions, including any deficiency in the required contributions of the optional retirement program established under Section 15-158.2 of the Illinois Pension Code, is less than the total amount of the vouchers for required State contributions lawfully submitted by the retirement system for that month under Section 15-165 of the Illinois Pension Code. (c) There is hereby appropriated from the Common School Fund to the Teachers’ Retirement System of the State of Illinois, on a continuing monthly basis, the amount, if any, by which the total available amount of all other appropriations to that retirement system for the payment of State contributions is less than the total amount of the vouchers for required State contributions lawfully submitted by the retirement system for that month under Section 16-158 of the Illinois Pension Code. (d) There is hereby appropriated from the General Revenue Fund to the Judges Retirement System of Illinois, on a continuing monthly basis, the amount, if any, by which the total available amount of all other appropriations to that retirement system for the payment of State contributions is less than the total amount of the vouchers for required State contributions lawfully submitted by the retirement system for that month under Section 18-140 of the Illinois Pension Code. (e) The continuing appropriations provided by subsections (a), (b), (c), and (d) of this Section shall first be available in State fiscal year 1996. The continuing appropriations provided by subsection (h) of this Section shall first be available as provided in that subsection (h). (f) For State fiscal year 2010 only, the continuing appropriations provided by this Section are equal to the amount certified by each System on or before December 31, 2008, less (i) the gross proceeds of the bonds sold in fiscal year 2010 under the authorization contained in subsection (a) of Section 7.2 of the General Obligation Bond Act and (ii) any amounts received from the State Pensions Fund. (g) For State fiscal year 2011 only, the continuing appropriations provided by this Section are equal to the amount certified by each System on or before April 1, 2011, less (i) the gross proceeds of the bonds sold in fiscal year 2011 under the authorization contained in subsection (a) of Section 7.2 of the General Obligation Bond Act and (ii) any amounts received from the State Pensions Fund. (h) There is hereby appropriated from the Common School Fund to the Public School Teachers’ Pension and Retirement Fund of Chicago, on a continuing monthly basis, the amount, if any, by which the total available amount of all other State appropriations to that Retirement Fund for the payment of State contributions under subsection (d) of Section 17- 127 of the Illinois Pension Code is less than the total amount of the vouchers for required State contributions lawfully submitted by the Retirement Fund for that month under that Section 17-127.”; and On page 45, by replacing lines 12 through 14 with: “formula under Section 18-8 of the School Code until all economic development projects costs have” On page 109, by replacing lines 12 through 13 with: “the School Code, until” On page 120, by replacing lines 12 through 13 with: “Code, until all redevelopment”

On page 124, by replacing lines 15 through 17 with: “school aid formula under Section 18-8 of the School Code, until all economic development projects costs have” On page 193, by replacing lines 14 through 16 with: “reimbursement level;”; and On page 330, by deleting lines 2 through 7; and On page 332, by deleting lines 9 through 13; and On page 332, by replacing lines 17 through 22 with: “Employee benefits” means health, dental, and vision insurance offered to employees of an Organizational Unit, Social Security employer contributions, and Illinois Municipal Retirement Fund employer contributions.”; and On page 333, by deleting lines 20 through 22; and On page 336, by deleting lines 13 through 14; and On page 337, by replacing line 20 through 26 with the following: “Organizational Unit CWI” is determined by calculating the CWI in the region and original county in which an Organizational Unit’s primary administrative office is located as set forth in this paragraph, provided that if the Organizational Unit CWI as calculated in accordance with this paragraph is less than 0.9, the Organizational Unit CWI shall be increased to 0.9, and provided that if the Organizational Unit CWI as calculated in accordance with this paragraph is greater than 1.04, the Organizational Unit CWI shall be decreased to 1.04. Each county’s current CWI value shall be”; and On page 338, by deleting line 16 through 20; and On page 339, by deleting lines 16 through 17; and On page 349, by replacing line 22 with: “each investment.” By deleting lines 23 on page 349 through line 15 on page 350; and On page 352, by replacing line 6 with : “Essential Elements, the State Superintendent shall”; and On page 353, by replacing lines 10 and 11 with: “following salaries shall be used:”; and On page 353, by deleting lines 16 through 18; and On page 354, by replacing line 22 with: “Adjusted EAV by its”; and On page 356, by deleting lines 16 through 24; and By deleting line 24 on page 359 through line 15 on page 360; and By deleting line 12 on page 361 through line 13 on page 362; and On page 363, by replacing line 4 with “$13,121,600.”; and By deleting line 5 on page 363 through line 12 on page 364; and On page 364, by replacing line 13 with: “For Specially Funded Units, the Base Funding”; and On page 364, by replacing line 17 with: “(2) For the 2018-2019 school year through the 2019- 2020 school year, the Base”; and On page 364, immediately after line 21, by inserting the following: “(3) Beginning with the 2020-2021 school year and every school year thereafter, the Base Funding Minimum of an Organizational Unit shall be the sum of (i) the Evidence-Based Funding for the prior school year and (ii) the Base Funding Minimum for the prior school year divided by the Organizational Unit’s ASE for the prior school year multiplied by the Organizational Unit’s ASE for the current school year. For Specially Funded Units, the Base Funding Minimum shall be the sum of (i) the Evidence-Based Funding for the prior school year and (ii) the Base Funding Minimum for the prior school year.”; and On page 367, by replacing lines 6 through 7 with the following: “to one minus the Organizational Unit’s Local Capacity Percentage. Each Organizational Unit within Tier 3 or Tier 4” By deleting line 3 on page 370 through line 1 on page 371; and On page 371, by replacing line 2 with the following: “(9) In the event of a decrease in the amount of the” On page 371, by replacing line 25 with the following: “(10) The State Superintendent shall make minor adjustments” With these changes, Senate Bill 1 will have my approval.

I respectfully request your concurrence.

Sincerely,

Bruce Rauner GOVERNOR