Click here to subscribe FREE to Ray Hanania's Columns

Preckwinkle and Pappas announce on-time First Installment tax bills, ensuring prompt distributions to taxing agencies

Property owners face an important tax deadline in the coming weeks, and Cook County Board President Toni Preckwinkle and Treasurer Maria Pappas are encouraging residents to plan ahead and take advantage of available payment tools.

First Installment property tax bills for 2025 will be mailed by March 2 and will be due April 1, for nearly 1.8 million Cook County properties.

That’s a month later than usual because we pushed lawmakers for the extension to give property owners some breathing room after second installment bills for 2024 were late.

And although bills will likely be arriving in mail boxes early next month, property owners can pay online for free as soon as February 20 by clicking here.

For those unable to pay their prior Second Installment bill in full, there’s a free Payment Plan Calculator, available now by clicking here. The tool allows taxpayers to create customized monthly or twice-monthly payment schedules and to develop plans to catch up on delinquent taxes over $100.

First Installment 2025 collection money will be distributed to more than 2,000 local government agencies within 30 days after receipt of the funds.

No one ever looks forward to receiving a tax bill, but timely billing reflects responsible government. Our offices remain in close coordination to continue improving the system, with staff in regular communication throughout the day to keep the process moving forward. We will issue further updates as key milestones are reached.

Click here to subscribe FREE to Ray Hanania's Columns

- Preckwinkle and Pappas announce on-time First Installment tax bills, ensuring prompt distributions to taxing agencies - February 17, 2026

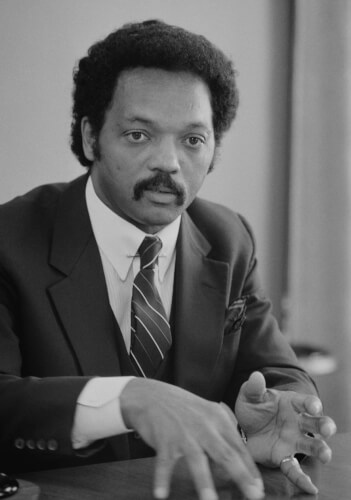

- Statement of Attorney Jeffery M. Leving on the Death of the Rev. Jesse Jackson - February 17, 2026

- John Harrell: Legacy of Rev. Jesse L. Jackson fuels foundation of civil rights for all - February 17, 2026