Click here to subscribe FREE to Ray Hanania's Columns

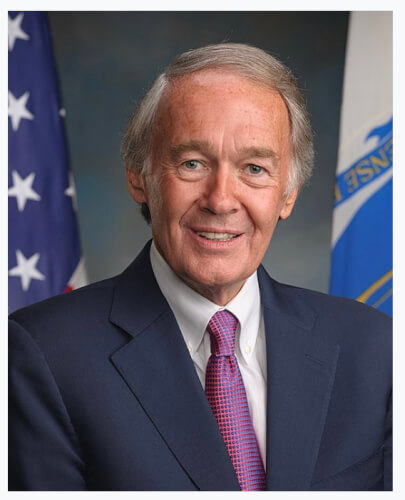

Hastings introduces bill to protect consumers in insurance rate setting

State Senator Michael E. Hastings has introduced Senate Bill 2691, legislation that would examine whether Illinois families are paying unfairly high premiums due to nondriving factors that have little to do with actual risk on the road or in the home.

“Families in Illinois deserve to know that when they pay for insurance, the cost is based on their real risk and not on factors that may be discriminatory,” said Hastings (D-Frankfort).

“This legislation is about protecting consumers, ensuring fairness and shining a light on practices that too often leave working people paying more simply because of their financial background or career path.”

The measure, known as the Non-Driving Factors in Insurance Rate Setting Study Act, directs the Illinois Department of Insurance to conduct a thorough review of how insurers use criteria such as credit scores, occupations, education levels and other socioeconomic factors to determine automobile and homeowners insurance rates.

Under Senate Bill 2691, the Department of Insurance would be required to:

· Investigate how nondriving factors are currently being applied in rate setting.

· Measure the relationship between these factors and actual claims data.

· Review whether reliance on such factors disproportionately harms low-income families, communities of color, veterans or seniors.

· Compare Illinois practices with those in states that have already limited or banned the use of nondriving factors.

· Provide recommendations to lawmakers on how to make rates more transparent and equitable.

The department would deliver its findings to the General Assembly by January 1, 2027.

“Consumers have a right to transparency,” said Hastings. “Insurance should be a shield that protects families, not a burden that penalizes them for circumstances unrelated to risk. This study will give us the facts we need to ensure Illinois families are treated fairly.”

Hastings is committed to ensuring Illinois families are not burdened by unpredictable insurance costs and plans to work over the coming months to pass the legislation.

- Dad and Sons Reunited After Painful Separation - January 23, 2026

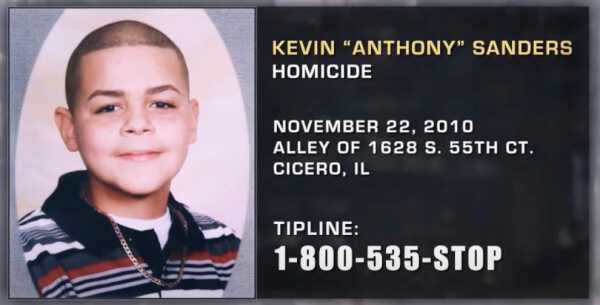

- Cicero Man Charged in Fatal Stabbing - January 21, 2026

- City Paid Tens of Millions in Overtime to Potentially Ineligible Employees, OIG Finds - January 21, 2026